DIY InvestorMagazine

/

March2014

38

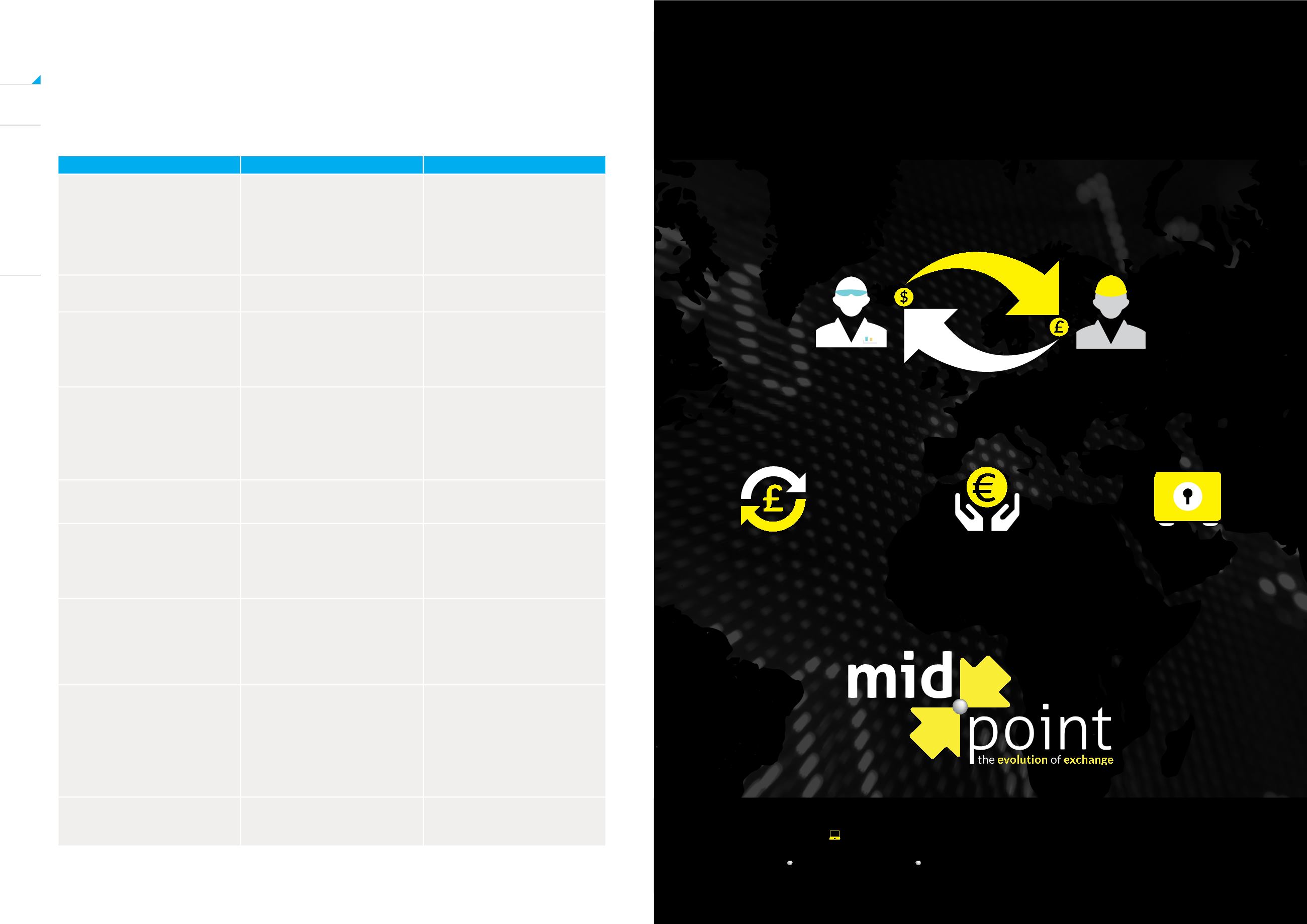

ISAVS PENSION

ATAGLANCE

PENSION

ISA

What is the tax position of my

contributions?

Contributions direct from salary before

tax. Individual pensions claim tax back

on your contributions. Basic rate tax

payers get a £125 benefit from every

£100 contribution. Higher rate tax

payers can reclaim a further 20%.

Generallymore efficient than savings

accounts but you are saving income

that has already been taxed unlike a

pension.

Canmy employer contribute?

Yes

No

What if I’mmade redundant

Assuming no contributions aremade,

your pension pot will remain static. A

large pension pot will not affect your

entitlement to state benefits.

A high amount of savings in an ISA

will affect your entitlement to certain

means-tested state benefits.

What is the investment risk?

There is a risk that the value of your

pot could fall, but generally you have

the option to select funds that reflect

your appetite for risk.

Cash ISAs have no investment risk

althoughmany pay less than inflation

so your capital is thereby eroded.

Stocks and shares ISA carry investment

risk and can fall as well as rise in value.

When can I access mymoney?

Not until age 55

Anytime although sometimes with a

penalty.

Options at retirement?

25% lump sum tax free. Purchase

annuity or remain invested and draw

down income. From 2015 – potentially

take entire pot and reinvest

Entirely flexible - take an income from

the interest or investment returns Draw

down an income from the ISA pot.

In the event of death?

If you have purchased an annuity the

provider keeps the remainder. Any

proceeds left in income drawdown

passes to your beneficiaries after the

deduction of tax at 55%.

ISA savings form part of your estate. If

your total estate exceeds £325,000 you

will be subject to Inheritance Tax.

Will my income run out before I die?

An annuity guarantees you an income

for the rest of your life.

It is possible that you could run

out of money under a drawdown

arrangement.

If you only use interest or returns

from your ISA pot, then (depending on

investment performance) your income

should not run out in your lifetime. If

you decide to take a regular portion of

your ISA pot as income, you could use

this up.

How is my income taxed?

When you take your pension income, it

will be subject to Income Tax.

Your income will be tax-free.

Dan is a widely published and quotedmarketing professional withmany years’

experience of working in the workplace savings sector