DIY Investor Magazine

/

September 2016

16

THE SCRAMBLE FOR DIVIDENDS IN

ASIA IS JUST GETTING STARTED

Henderson Far East Income Ltd

In the West the grasp for yield has become a protracted

theme for investors. Income hungry, they have been

forced to search in non-traditional income asset classes

amid compressing bond yields from expansionary

central bank policies.

The UK government now rewards you a mere 0.6% a

year if you lend to them for 10 years. In Germany you’ll

need to pay them to take your money. As the risk-

reward dynamic has become skewed, income-yielding

equities have never been more en-vogue.

But what of the more traditionally high yielding markets

such as those in Asia?

In the past, heavyweight Asian investors such as large

pension funds and sovereign wealth funds have tended

to allocate their cash towards fixed income assets and

property. This made sense. With yields significantly

higher than Western markets, exposure to the additional

capital risk in equities would have been nonsensical.

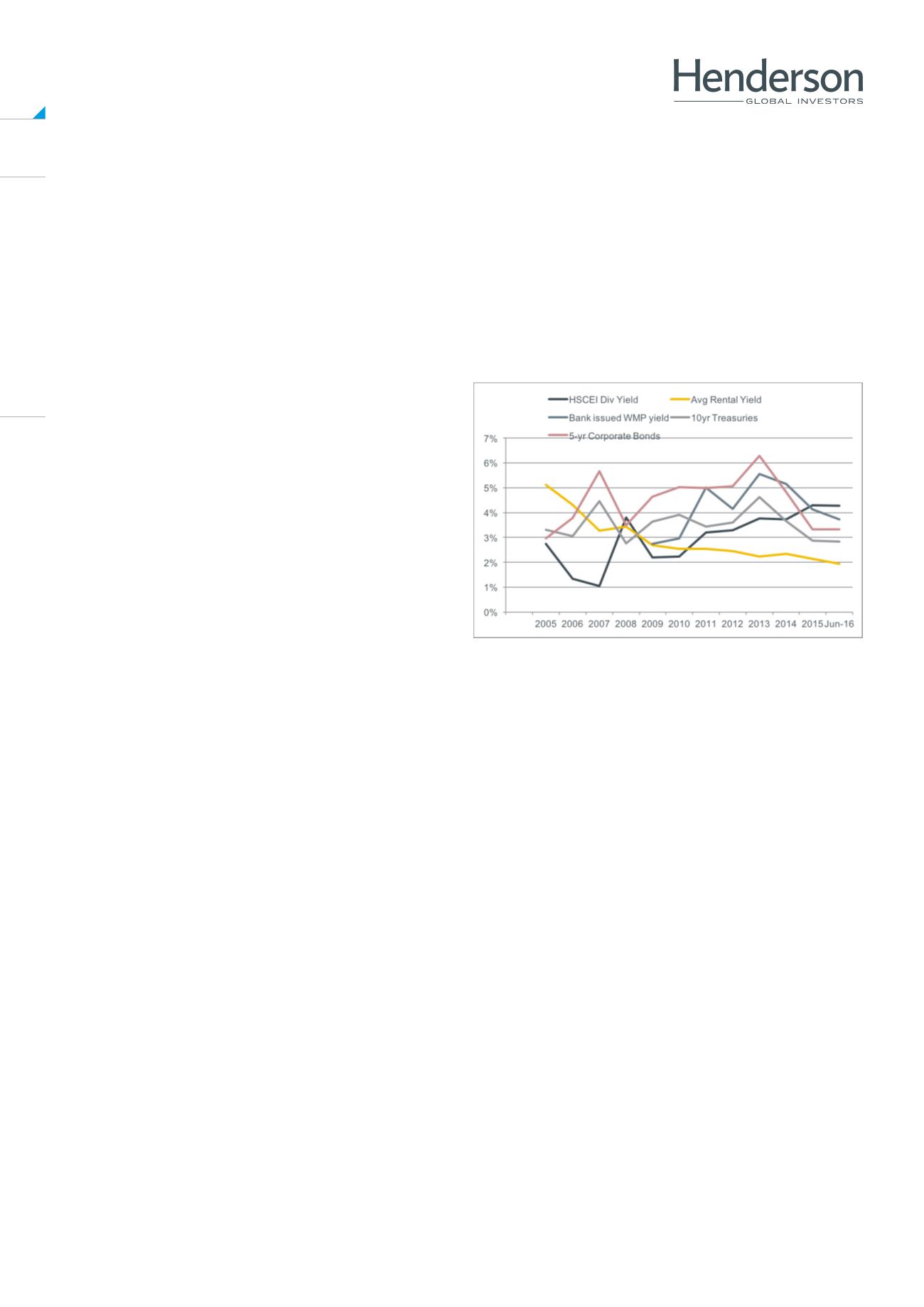

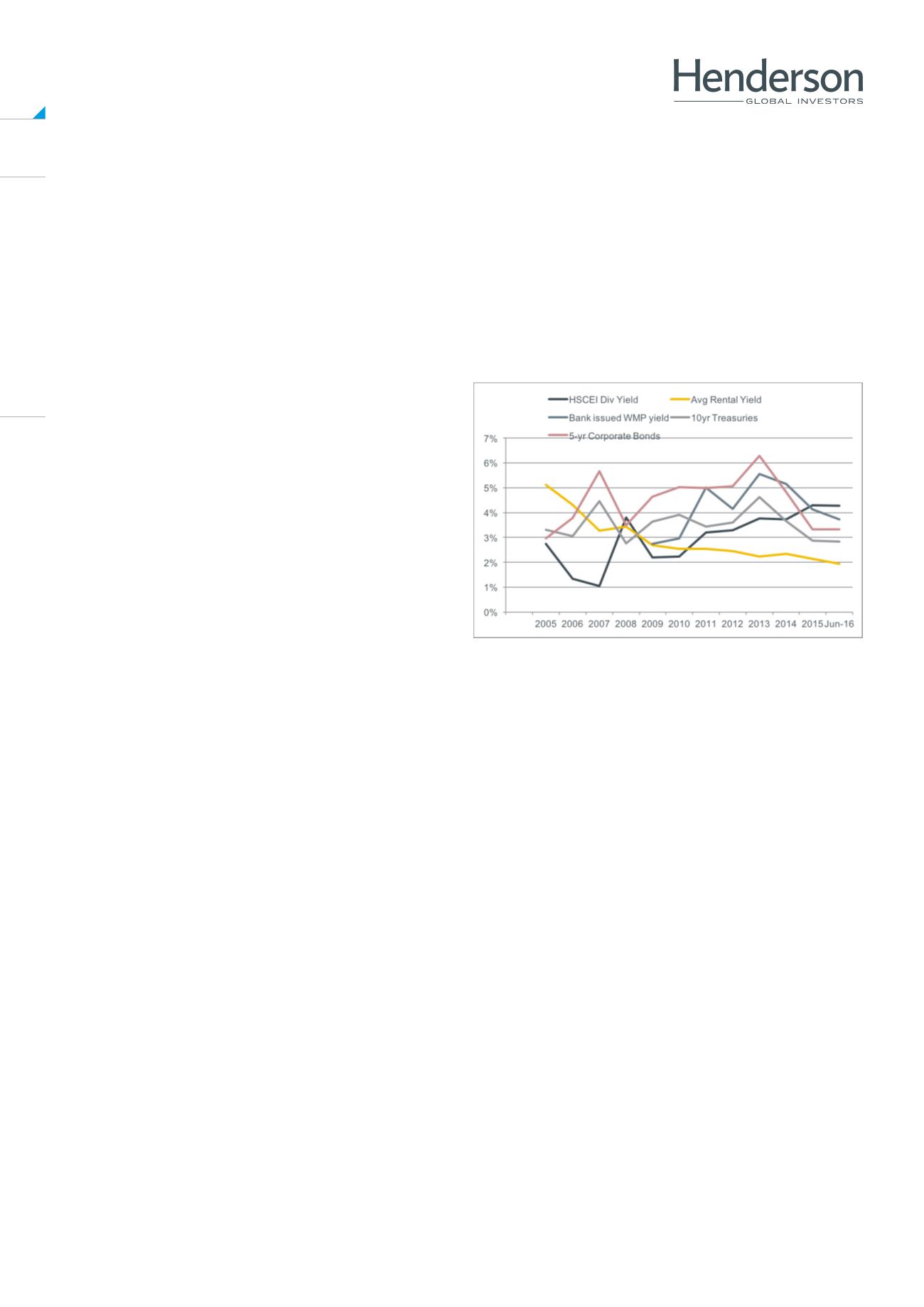

Recent evidence points to a shifting landscape in this

regard. Look at data from the region’s stalwart economy

– China (see chart below) – and you’ll see yields have

been steadily dropping across a number of income

asset classes: government bonds, corporate bonds,

property, and even wealth management products.

The latter offer fixed-term pay-outs based on underlying

assets and have been hugely popular among retail

investors. Some of the non-bank wealth management

products (WMP) offered fairly high (and unsustainable)

yields in the past due to the spurious assets

underpinning them, and are now facing a government

clampdown.

Similar products sponsored by banks are deemed

safer, but yields have contracted to below 4% and

that of the main H-Shares equity market in Hong Kong

(HSCEI) and a growing number of shares listed in

Shanghai and Shenzhen, China - a far less compelling

proposition than 12 months ago.

Overall, the effect has been to squeeze all of the

traditional avenues for income, making equity yields –

rising on account of the improving corporate attitudes

towards shareholders and increasing pay-out ratios (the

percentage of net income paid out as dividends) – an

increasingly attractive income proposition on a risk

/ reward basis. The picture is reflected across most

Asian markets.

Source: Henderson Global Investors; Morgan Stanley: as at

17/08/2016. HSCEI – Hong Kong Seng China Enterprises Index

How are Investors Reacting?

Institutional investors, cognizant of the eroding value in

traditional income asset classes, have been changing

their allocations towards equities for the first time in

history. In Taiwan the risk-based capital requirements

for insurers and pension funds have been raised, which

could attract between $25 and $35bn towards equities

over the next five years. Singapore’s sovereign wealth

fund, GIC, is in talks to buy 7% of Vietcombank in

Vietnam. In India, the biggest retirement manager has

recently been permitted to invest 5 – 15% of new assets

in equities, where before they had not been allowed.

And the tendency has been for dividend paying

stocks with low betas – those of lower volatility when

compared with the wider market. A market-cap

weighted index of 44 Asian stocks with dividends above

3% and betas of between 0.8 - 1.0 (less than one

implies lower volatility than the market; more than one

implies greater) has been climbing, especially since the

Bank of Japan introduced negative interest rates.