DIY Investor Magazine

/

September 2016

40

INVESTING IN THE DIGITISATION

OF PAYMENTS

PREPARING FOR ‘BREXIT’

Unfortunately it wasn’t just the torrential downpours

that dampened spirits in June: the UK’s EU in/out

referendum on the 23rd likely won in this regard. With

markets around the world pricing-in a higher probability

of ‘remain’, ‘Brexit’ caught many by surprise. On the

morning following the result, markets plunged. In

the spate of a few days Sterling dropped nearly 11%

against the dollar; the FTSE-250 – the UK’s more

domestically focused smaller-cap market – sank over

13.5%. The ensuing political mayhem left heads rolling

from the spectrum’s left, right and centre.

Although markets have largely recovered since the

result, Alex Crooke of The Bankers Investment Trust

was cautious in the run-up to Brexit. He and the board

of directors – a unique, independent, client-focused

feature of investment trusts – decided almost a year

ago, without taking a view on the outcome, that it would

be prudent to pare-back risk and reduce Bankers’

exposure to the UK. It proved to be the right decision. It

highlights the advantages of a global generalist such as

Bankers: with its mandate to invest in any stock market

in the world, Alex is unrestrained and can shift capital

to where he finds the best value.

THE LAND OF OPPORTUNITY

In a shifting picture of asset allocation for the portfolio

one region that remains a high weighting is the US

stock market. It is by far the largest equity market in the

world. The economy is growing at a faster clip than any

other developed economy, and predicted to continue

as such for at least the next few years. House prices

continue to rise, consumer spending is firm, and the

jobs market is strong with the Fed believing it near full

employment.For Alex, while the economic picture is

important the portfolio’s focus is to uncover promising

stocks at reasonable valuations. The focus for the US

sleeve of the portfolio has been growth-at-the-price

(GARP) - companies in the growth phase of their

development but where the implied growth appears

not to be overvalued. Stocks are picked with the help

of a number of overarching themes. Investment themes

describe where perceived long-term trends underpin

the growth of a particular area of a market, for example

where fund managers believe the application of a new

technology or government policy will continue to drive

consumer demand in a particular market for many

years to come.

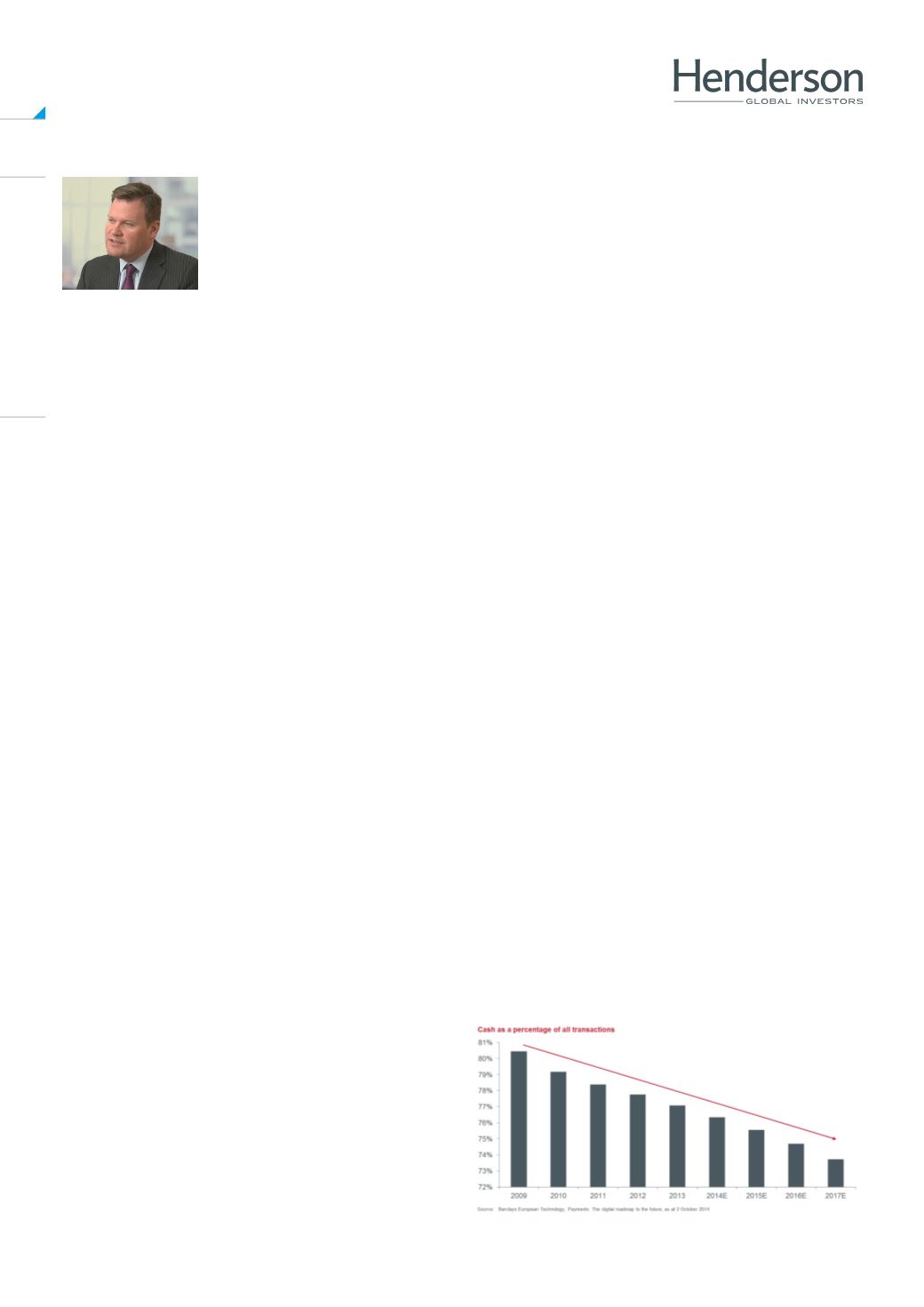

CARD OR CASH?

One such theme is Paperless Payments. It represents

the classic scenario where technology is an enabler for

‘convenience’. It regards the shift from cash payments

to digital payments on debit and credit cards, and is

coupled with the adoption of newer technologies, such

as Apple Pay, in developed economies and mobile

payments in the developing economies.

Aside from convenience and time savings for users,

electronic payments are more reliable and secure, and

can reduce transaction costs for businesses. Customer

retention is likely to be higher, with those more willing

to stick with a company or website where they have

formerly entered their personal details. This potentially

increases sales and encourages larger transaction

amounts, explaining why cash as a percentage of

transactions continues to shrink (see chart) while mobile

payments have been rising at a compound annualised

growth rate of more than 50% since 2010.

Alex Crooke,

Henderson

Bankers Investment Trust