DIY Investor Magazine

/

March 2017

44

Jenna Barnard

Co-head Strategic Fixed Income, Henderson Global Investors

REFLATION FOR NOW, BUT HOW LONG WILL IT LAST?

There is a strong consensus in financial markets these

days. Post the election of Donald Trump headlines such

as ‘regime change’ and ‘the Trump reflation trade’ have

dominated the financial media as investors happily

embraced the ‘reflation’ trend and started to put their

money to work based on the view that growth and

inflation are going to rise. This has favoured equities

over bonds..

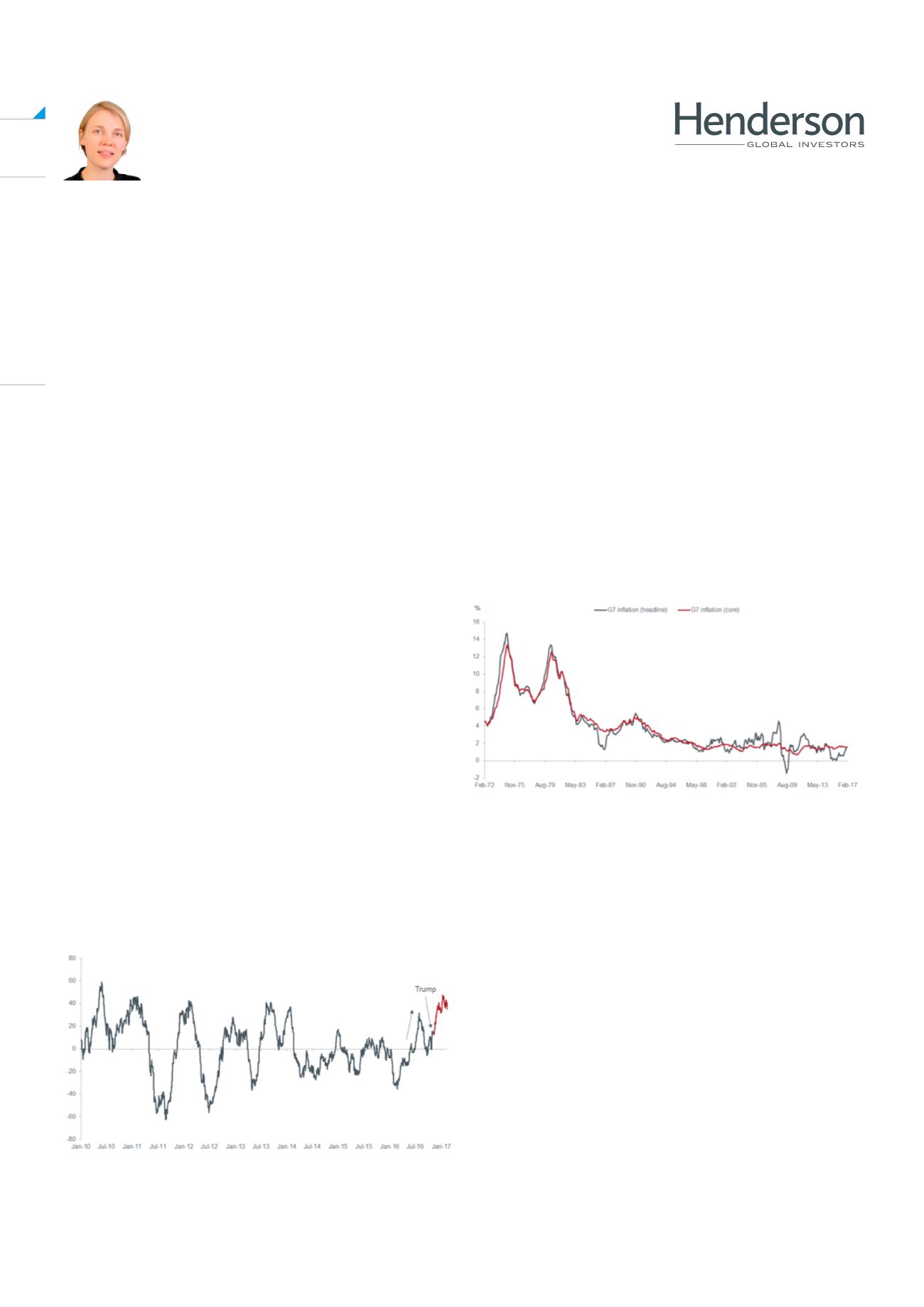

However, the catalyst for the rise in bond yields pre-

dates the US elections; since mid-2016 there have

been signs that growth was picking up in the major

economies. Economic surprise indices such as the

G10 Citigroup Economic Surprise Index, show that

economies were experiencing a cyclical uplift prior to

Trump’s election, and Purchasing Managers’ Indices

(PMIs) were indicating a concerted uptick in global

activity.

This uptick occurred in response to a number of factors,

including a loosening of monetary policy in China about

a year earlier, sparking a rally in commodities. Thus,

the rotation seen in equities from defensives to cyclicals

and banks, the consensus move on being long the US

dollar and rising bond yields were already in progress.

Trump’s election simply amplified it — a ‘Trump bump’ if

you like (see chart 1).

Chart 1: Major economies were experiencing a

cyclical uplift pre-Trump

REFLATION FOR NOW, BUT HOW LONG WILL IT

LAST?

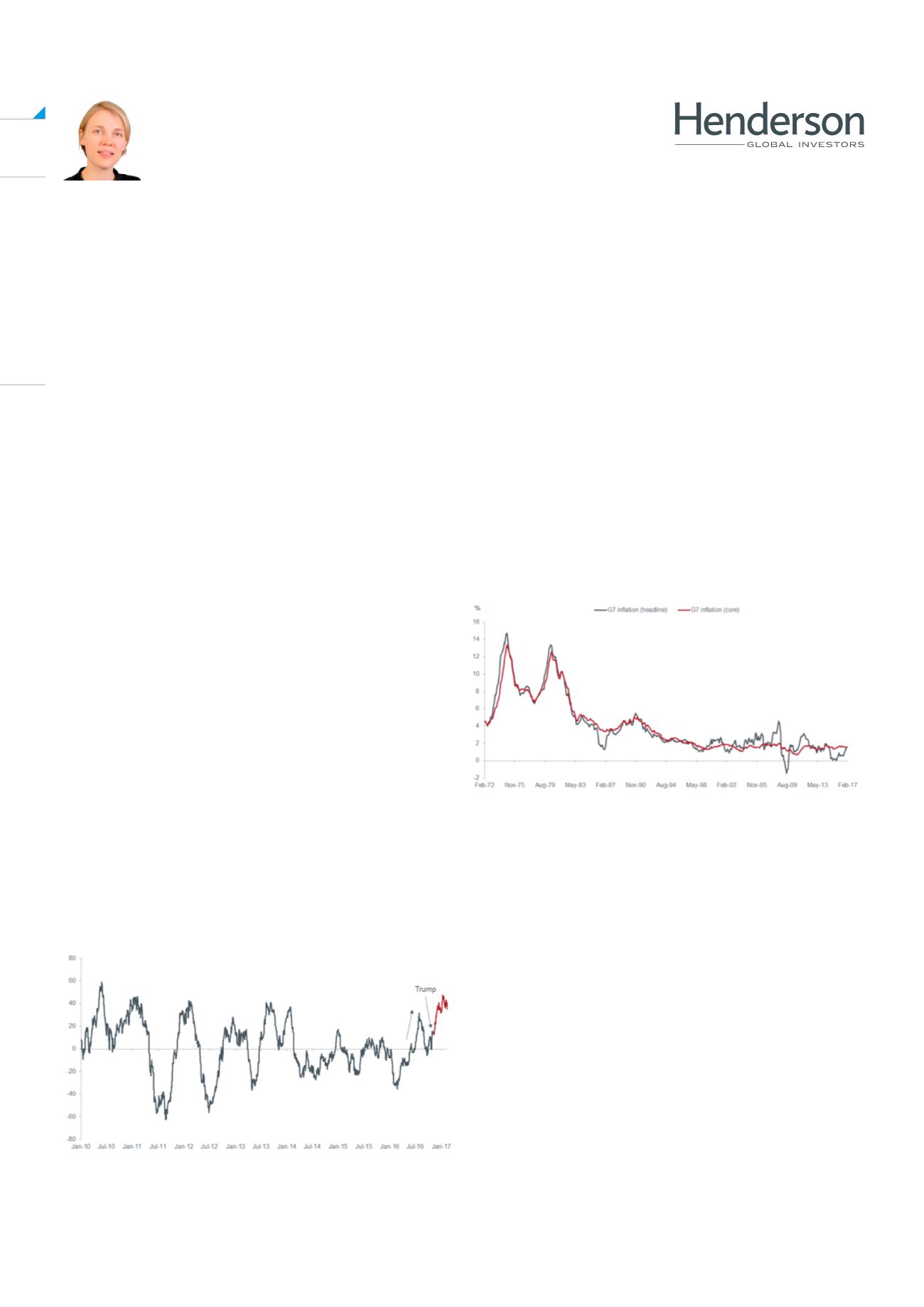

Headline inflation is on the rise around the globe on the

back of rising commodity prices, while core inflation

(which excludes volatile items such as food and energy)

remains more muted (see chart 2). In the US the tick

up in activity and expectations of expansionary policies

have helped the trend, while in the UK the commodity

uptick has been exacerbated by a weakening sterling

following the Brexit vote. Headline inflation trends are

similarly on the way up in Europe and Japan.

CHART 2: DIFFERENTIATING CORE FROM

HEADLINE INFLATION

Source: Bloomberg, G10 Citi Economic Surprise Index,

as at 14 February 2017

Source: Bloomberg, monthly data, as at 31 January

2017

Given the current inflation expectations, consensus

among market participants now appears to be for a rise

in 10 year US Treasury bond yields to 3%, which would

represent a further significant sell-off (lower prices) in

bonds. Additionally, data shows that short positions in

US government bond futures have reached extreme

levels compared to history.

A cyclical uptick and not a structural trend

We believe the current uptick to be cyclical in nature,

which should not be confused with the long term

structural issues that we have talked about for so long

— weak productivity, demographics and digitalisation

to name but a few — that ultimately lead to lower growth

and subdued inflation.