DIY Investor Magazine | Issue 29

Page 36 - DIY Investor Magazine | Issue 29

P. 36

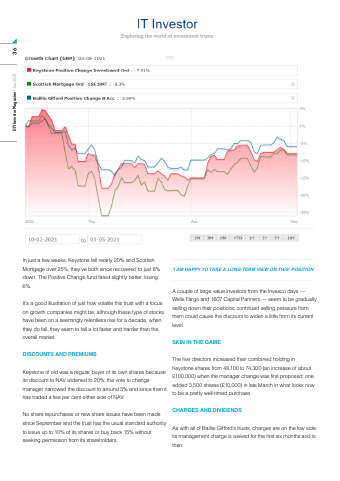

In just a few weeks, Keystone fell nearly 20% and Scottish Mortgage over 25%; they’ve both since recovered to just 8% down. The Positive Change fund fared slightly better, losing 6%.

It’s a good illustration of just how volatile this trust with a focus on growth companies might be; although these type of stocks have been on a seemingly relentless rise for a decade, when they do fall, they seem to fall a lot faster and harder than the overall market.

DISCOUNTS AND PREMIUMS

Keystone of old was a regular buyer of its own shares because its discount to NAV widened to 20%; the vote to change manager narrowed the discount to around 5% and since then it has traded a few per cent either side of NAV.

No share repurchases or new share issues have been made since September and the trust has the usual standard authority to issue up to 10% of its shares or buy back 15% without seeking permission from its shareholders.

‘I AM HAPPY TO TAKE A LONG-TERM VIEW ON THIS’ POSITION

A couple of large value investors from the Invesco days — Wells Fargo and 1607 Capital Partners — seem to be gradually selling down their positions; continued selling pressure from them could cause the discount to widen a little from its current level.

SKIN IN THE GAME

The five directors increased their combined holding in Keystone shares from 48,100 to 74,300 (an increase of about £100,000) when the manager change was first proposed; one added 3,500 shares (£10,000) in late March in what looks now to be a pretty well-timed purchase.

CHARGES AND DIVIDENDS

As with all of Baillie Gifford’s trusts, charges are on the low side; its management charge is waived for the first six months and is then:

DIY Investor Magazine | Jun 2021 36