Page 21 - DIY Investor Magazine | Issue 34

P. 21

While this is definitely a positive, there is still an important role for us to play, as shareholders, by encouraging companies to take a wider, more global, view of sustainability, rather than simply a local focus.

While there is always an important role for us, as shareholders, in encouraging management to take a broad view of sustainability, many Japanese companies themselves share a long tradition of commitment to society.

This is typified by Itochu, now a major global trading company, whose mission statement, for over 150 years, has aimed to unite the needs of the buyer, the seller and society.

‘CHANGING CORPORATE GOVERNANCE TRENDS ARE SEEING COMPANY MANAGEMENT PAY GREATER ATTENTION TO SHAREHOLDER RETURNS’

FOCUS ON SHAREHOLDERS HAS IMPROVED

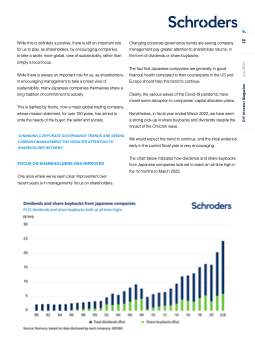

One area where we’ve seen clear improvement over recent years is in managements’ focus on shareholders.

Changing corporate governance trends are seeing company management pay greater attention to shareholder returns, in the form of dividends or share buybacks.

The fact that Japanese companies are generally in good financial health compared to their counterparts in the US and Europe should help this trend to continue.

Clearly, the various waves of the Covid-19 pandemic have meant some disruption to companies’ capital allocation plans.

Nonetheless, in fiscal year ended March 2022, we have seen a strong pick-up in share buybacks and dividends despite the impact of the Omicron wave.

We would expect this trend to continue, and the initial evidence early in the current fiscal year is very encouraging.

The chart below indicates how dividends and share buybacks from Japanese companies look set to reach an all-time high in the 12 months to March 2023.

21

DIY Investor Magazine · July 2022