DIY Investor Magazine

| Oct 2017

30

KEEPING YOUR MONEY IN A CASH ISA IS

A WASTED OPPORTUNITY; SEE HOW DIY

INVESTING CAN BE PLANE SAILING WITH

SALTYDOGINVESTOR

By Douglas Chadwick

It’s frightening how much of people’s savings is just lying

around doing nothing. Why is this frightening? Because

if you want a comfortable retirement for yourself and

your family, you really should make sure that your money

is actively working for you – not just ‘sitting under the

mattress’.

According to figures from HM Revenue & Customs,

£270 billion is currently held in cash ISAs; with today’s

low interest rates, this money is earning virtually nothing

and, in many cases, is actually losing value.

Research by broker Hargreaves Lansdown has shown

that there’s a further £400 billion lying around in under-

performing ‘dinosaur’ investments such as with-profits

funds.

This is such a huge waste - if your money is in a cash

ISA or an underperformer, consider how much this is

costing you over the long term. It could be tens of thou-

sands of pounds. You have done the difficult bit, which

is to save this nest-egg and place it in an ISA protecting

it from future tax demands. Sadly, you have then sat on

your hands and not done the easy bit, which is to make

it grow in a safe and sensible fashion, while allowing

compound interest to be left to work its magic.

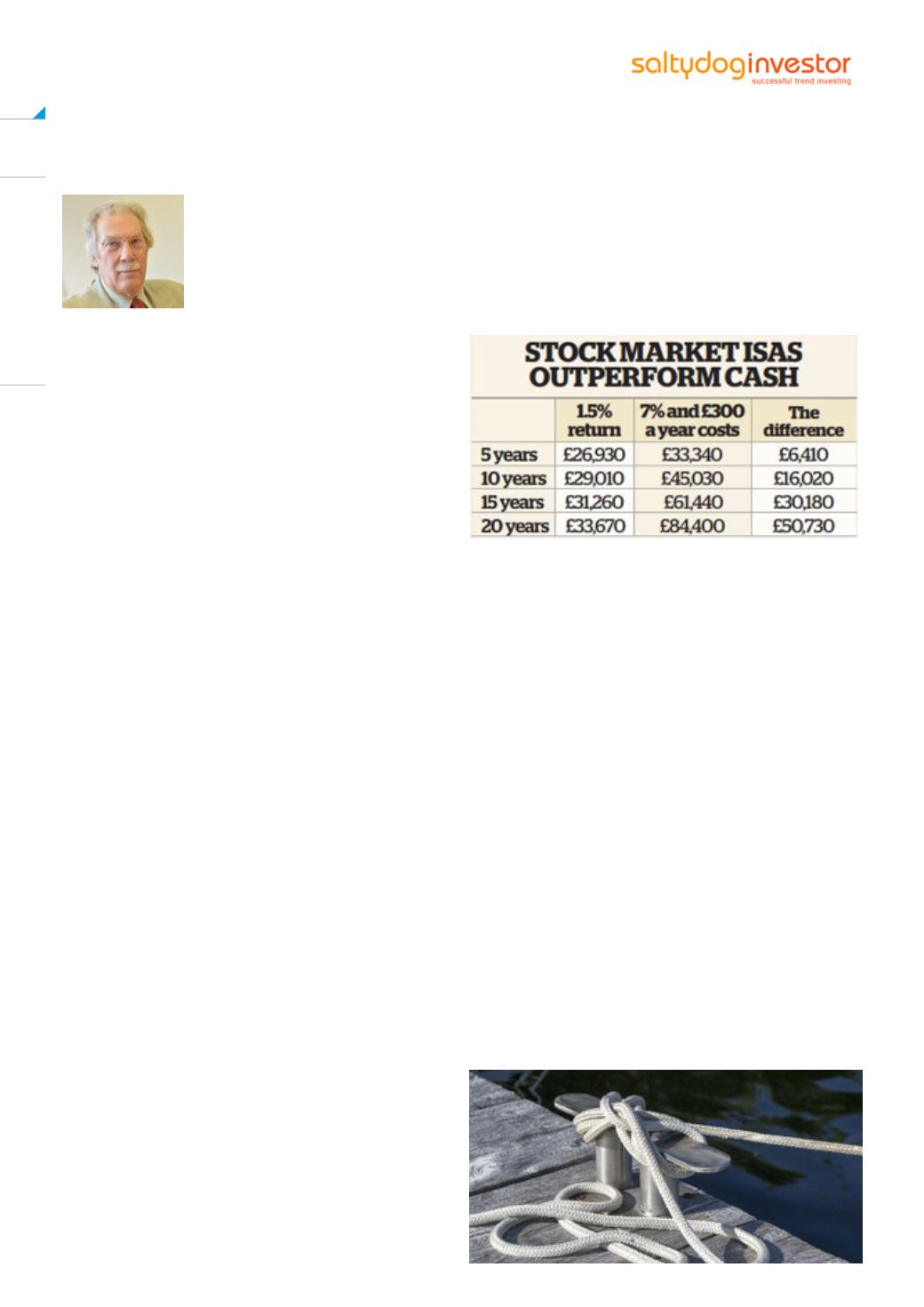

Let’s say you have £25,000 in savings. Just look at the

difference in returns over the next five to twenty years,

depending on whether you put that money in a cash ISA

or invest it conservatively in the stock market.

A cash ISA might give you 1.5% interest; a conservative

stock market investment could give you a 7% return,

and in this example, I’ve then deducted £300 a year for

costs. Here’s the startling difference in results:

As you can see, even after just five years the stock mar-

ket strategy is ahead by over £6,000. And if you keep

the stock market strategy going for 20 years, you could

be up over £50,000 and your savings pot could be more

than double the amount you would have made from a

cash ISA; that’s an enormous difference.

INDUSTRY NOT YOUR FRIEND

Please bear in mind, however, that the financial services

industry is not really motivated to help you out. Why?

Because its members still charge their fees, whether

your wealth increases or not. Your savings pot is your

baby and no-one else’s, and it’s in your hands to turn

the situation around.

Many people quite wrongly see stock market investing in

the same negative light as betting on a horse race. They

are put off by the perception that the risks are high and

the chances of winning are low. But that does not have

to be the case.