DIY Investor Magazine

| Oct 2017

38

MARKETS ARE HIGH; THE MEDIA AND SOME INVESTORS FEAR A FALL

– ARE THEY RIGHT?

The time to repair the roof is when the sun is shining’

John F. Kennedy – State of the Union Address 11

January 1962

There is lots of comment at present about how

far the markets have risen and if we are heading

for a correction, writes

David A Norman of TCF

Investments.

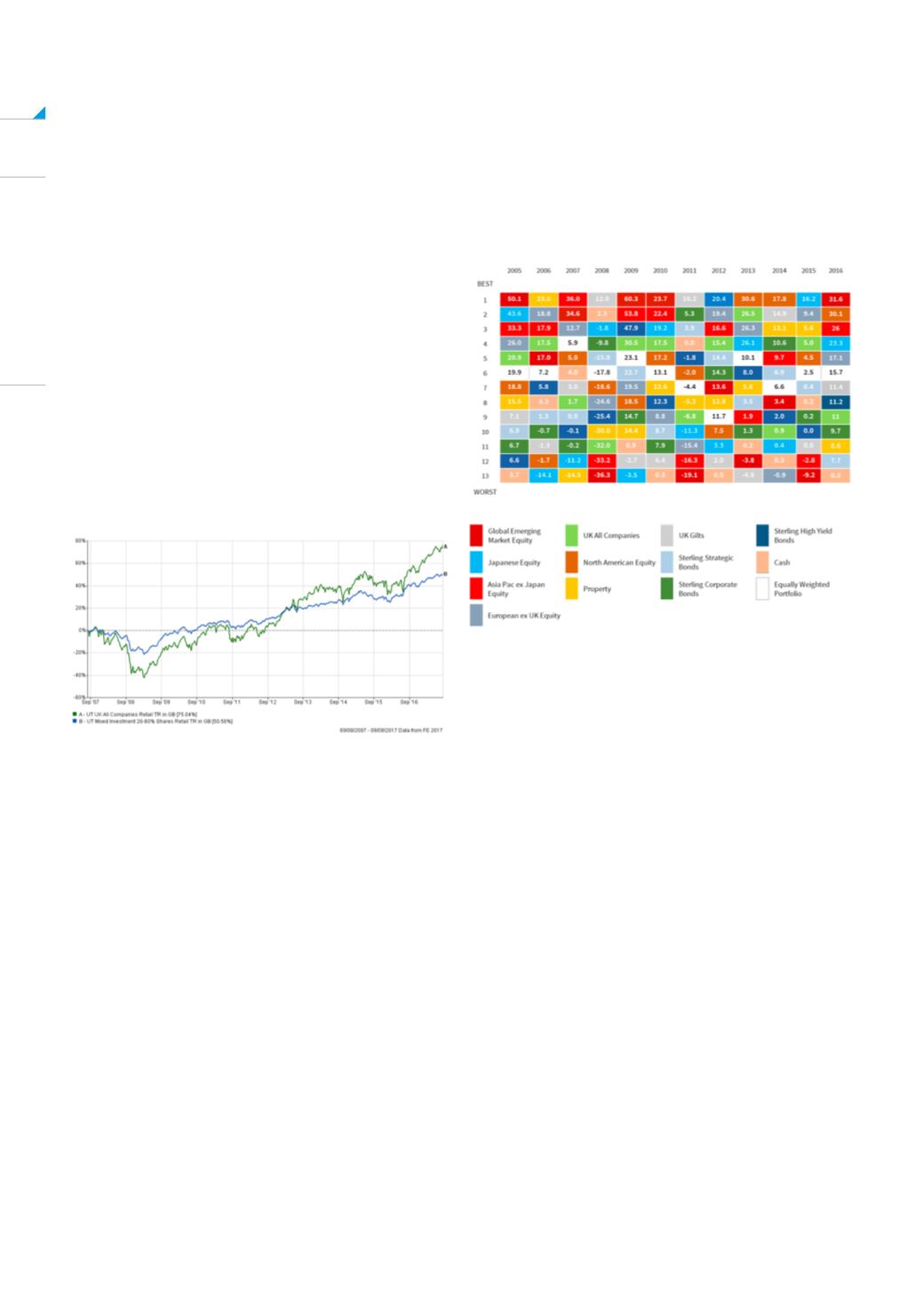

The chart below shows the ten years returns from the IA

sector averages UK All Companies and 20-60% Shares

(what might be called ‘balanced’). These averages show

75% and 50% total returns over ten years including the

2008/09 wobbles. The media and investors seem to

be pessimists – nervous investors may now be seeking

guidance about reducing risk, so what does the data

show?

Stock markets don’t rise all the time but they do gain

most of the time and it generally pays to take the

optimistic view, says analysis research from Proinsias

O’Mahony. “Stock markets do suffer frequent declines,

but the long-term trend has always been an upward

one. In the United States, equities have historically

gained in roughly three out of every four years, and

there has never been a 20-year period where stocks lost

money.

In the UK, stocks have beaten cash in 68% of two-year

periods and 75% of five-year periods, according to

Barclays’ annual Equity Gilt Study. Over 10 years, UK

stocks beat cash 91% of the time; over 18 years, the

beat rate rises to 99%. It’s a similar story with bonds,

with stocks outperforming the vast majority of the time.

Things aren’t always rosy, and sceptics can point to

disasters like Japan, where stocks have halved in value

since 1989’s infamous peak. It’s an unarguable fact,

however, that stock markets typically rise over time’.

EGGS IN BASKETS

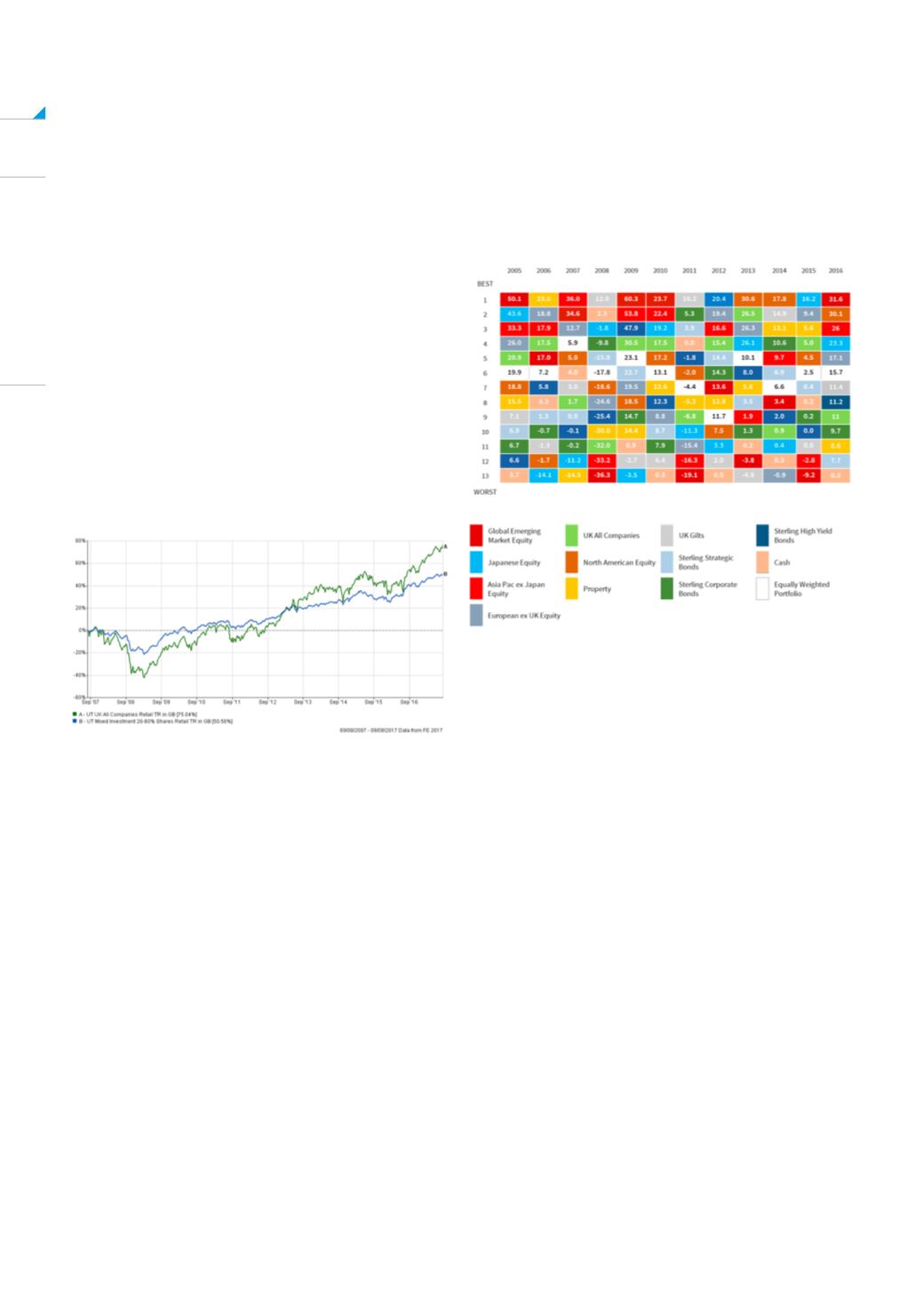

The figure below shows the returns over the last ten

discrete years from 12 IA sectors and an ‘equally

weighted’ portfolio of the 12. It clearly shows the benefit

of diversifying across a range of asset classes in

reducing downside risk.

NEGATIVITY BIAS

O’Mahony also notes that journalists have always

tended to be more negative about market declines

than they are positive about market gains, according

to Prof Diego Garcia. His study The Kinks of Financial

Journalism examined market coverage in the New York

Times and the Wall Street Journal over the last century,

and found it had ‘barely changed’ over that time period,

with ‘virtually all’ authors ‘emphasising negative returns,

ignoring large positive market moves’.

Earlier this year, Financial Times columnist John

Authers, one of the most thoughtful commentators in

the investment world, admitted his own writing is likely

to be similarly biased towards the negative. Firstly,

journalists view themselves as sceptical watchdogs,

‘the public’s first line of defence against people in the

industry trying to oversell them things’. Secondly, ‘we

are far more scared of encouraging readers to buy and

ushering them into a loss, than we are of urging them to

be cautious, and leading them to miss out on a gain’.

A journalist who tells readers to buy an Enron-like stock

would be vilified, said Authers, but no one complains if

you tell readers to avoid a stock which goes on to soar

in price. Of course, financial journalists are not the only

ones to be guilty of a negativity bias.