DIY Investor Magazine

|

Oct 2017

45

SELL IN MAY SECTOR STRATEGY (SIMSS)

The Sell in May Effect is one of the best known and

strongest market anomalies, but exploiting it can be

tricky. Here’s one way.

The idea is to stay in the market throughout the year

but to rebalance a stock portfolio according to which

sectors perform the best in the two six-month periods as

defined by the Sell in May Effect.

First, the performance of the respective FTSE 350

sectors is analysed for the two periods in recent years.

Then some filters are applied:

1.

Sectors with less than four component

stocks are not considered.

2.

Sectors must have a minimum 13-year

track record.

3.

Standard deviation (i.e. volatility) of a sector’s

returns must be below the average

standard deviation.

4.

Positive returns must be over 50%.

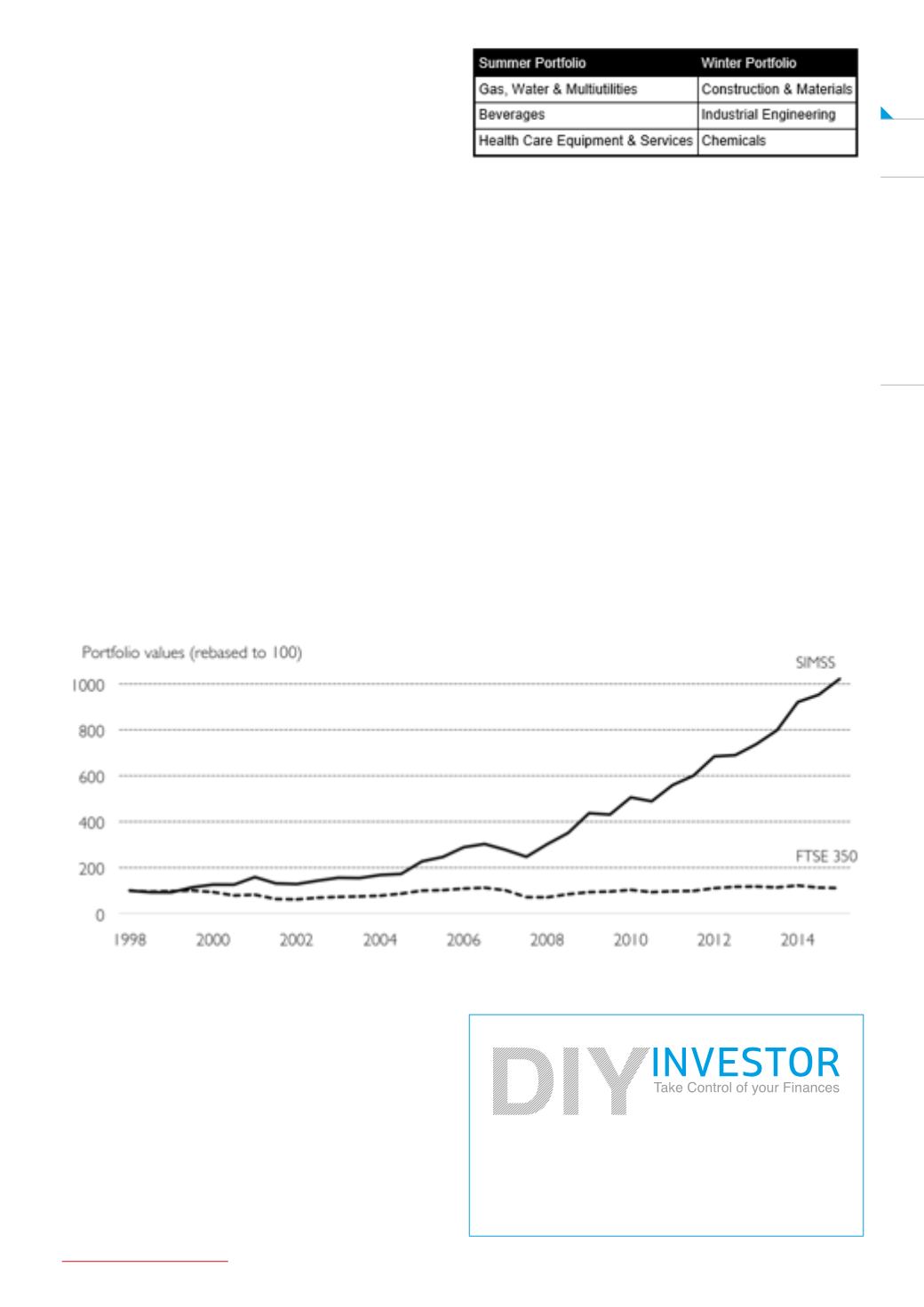

From this, the sector portfolios selected were:

The Sell in May Sector Strategy (SIMSS) is therefore:

In the summer period: long sectors Gas, Water &

Multiutilities, Beverages, and Health Care Equipment &

Services, and then switch to…

In the winter period: long sectors Construction &

Materials, Industrial Engineering, and Chemicals.

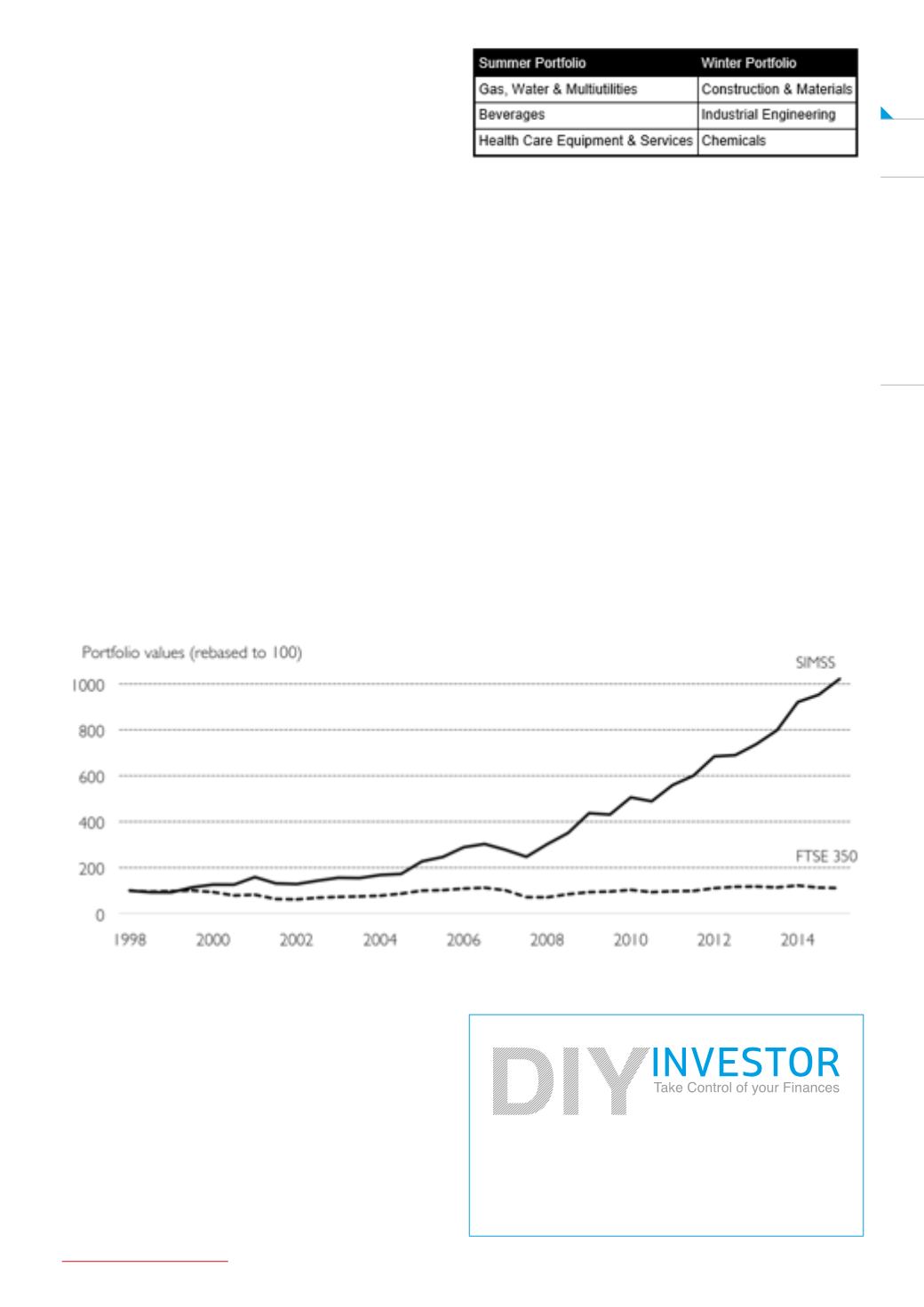

Performance of SIMSS.

The following chart shows the simulated performance

of the Sell in May Sector Strategy (SIMSS) backdated to

1999 compared to the FTSE 350.

After 17 years the SIMSS portfolio would have grown in

value to 1021 (from a starting value of 100), while the

FTSE 350 (buy and hold) portfolio would have grown to

111. This simulation does not include transaction costs,

but as the strategy only trades twice a year these would

not significantly affect the above results.

To purchase this book for the special DIY Investor price

of £18 + P&P (RRP £25) use the following promotional

code when checking out at the Harriman House online

bookshop: DiYEE15.