DIY Investor Magazine

| Oct 2017

42

OCTOBER MARKET SEASONALITY EFFECTS AND ANOMALIES

The latest edition of Stephen Eckett’s fascinating

reference book may have you scratching your

head in search of a rational explanation for what

is presented, but one thing is for sure, you’ll

return to it again and again as 2017 unfolds.

The UK Stockmarket Almanac

Market performance this month

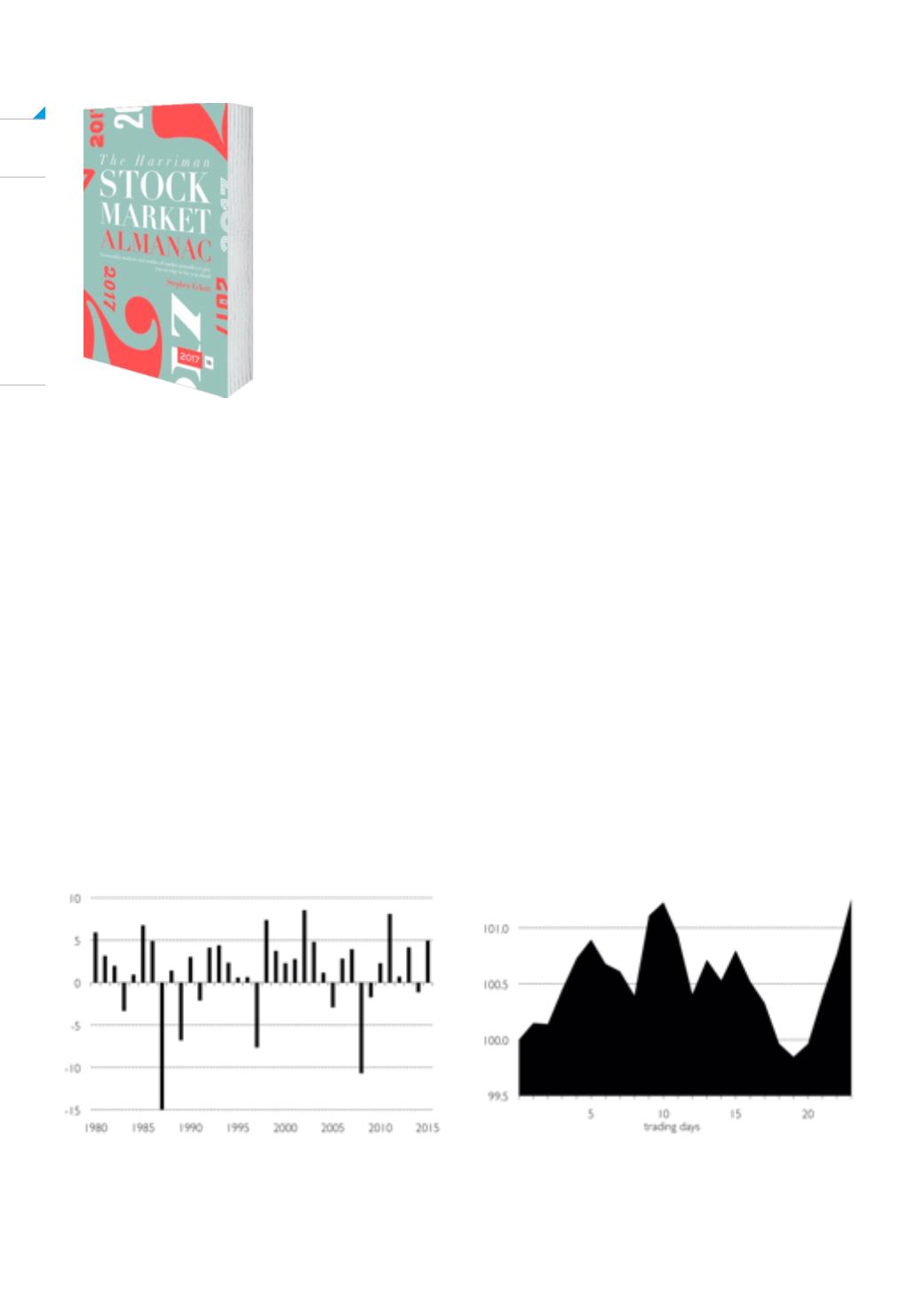

October can be a volatile month for equities. Since

1984, seven of the ten largest one-day falls in the market

have occurred in October. The largest fall occurred on

20 October 1987 when the FTSE 100 fell 12.2%. So, this

would appear to bode ill for investors in October.

However, if you look at the accompanying chart you will

see why averages don’t tell the whole story and how

things have changed in recent years.

For example, since 1992 the market has only fallen

in five years (and two of those of years were the

exceptional years of 2008 and 2009).

And since 2000, the average stock market return for

month has been 1.7%, making it the second best month

for equities after April in that period.

The strength of equities in October may not be

unconnected with the fact that the strong six-month

period of the year starts at the end of October (part of

the Sell in May effect) and investors may be anticipating

this by increasing their weighting in equities during

October. But while October, therefore, should be

regarded as a good month for shares, any occasional

weakness in the month can be severe.

In an average month for October, the market tends to

rise in the first two weeks then fall back, before a surge

in prices in the last few days of the month (Sell in May

Effect – aka Halloween Effect – again!)