DIY Investor Magazine

| August 2017

16

THE QUEST FOR INCOME: ARE WE FACING 2008 MARK II?

CONSIDERING HARD ASSETS FOR DESPERATE TIMES……

By Philip Gilbert, Director,

Aragonese Consulting Ltd*

Almost exactly 9 years ago my wife and I left for 2 weeks

holiday in southern Italy. At the time, I was working in the

global markets division of a global investment bank. The

signs weren’t good, and my immediate boss said have

a good holiday and remember, ‘something bad always

happens in September’.

By the time I returned, 2 weeks later, Lehman was bust,

as was Washington Mutual, Fannie and Freddie were in

government conservatorship, AIG on life-support, Merrill

was saved by BoA and, in the UK, HBoS had failed

and was to drag down Lloyds, and RBS, only recently

strutting its stuff as the world’s biggest bank, became

the world’s biggest bust! Me, I was sunning myself on

a deckchair, perversely I was gutted to miss all the

excitement!

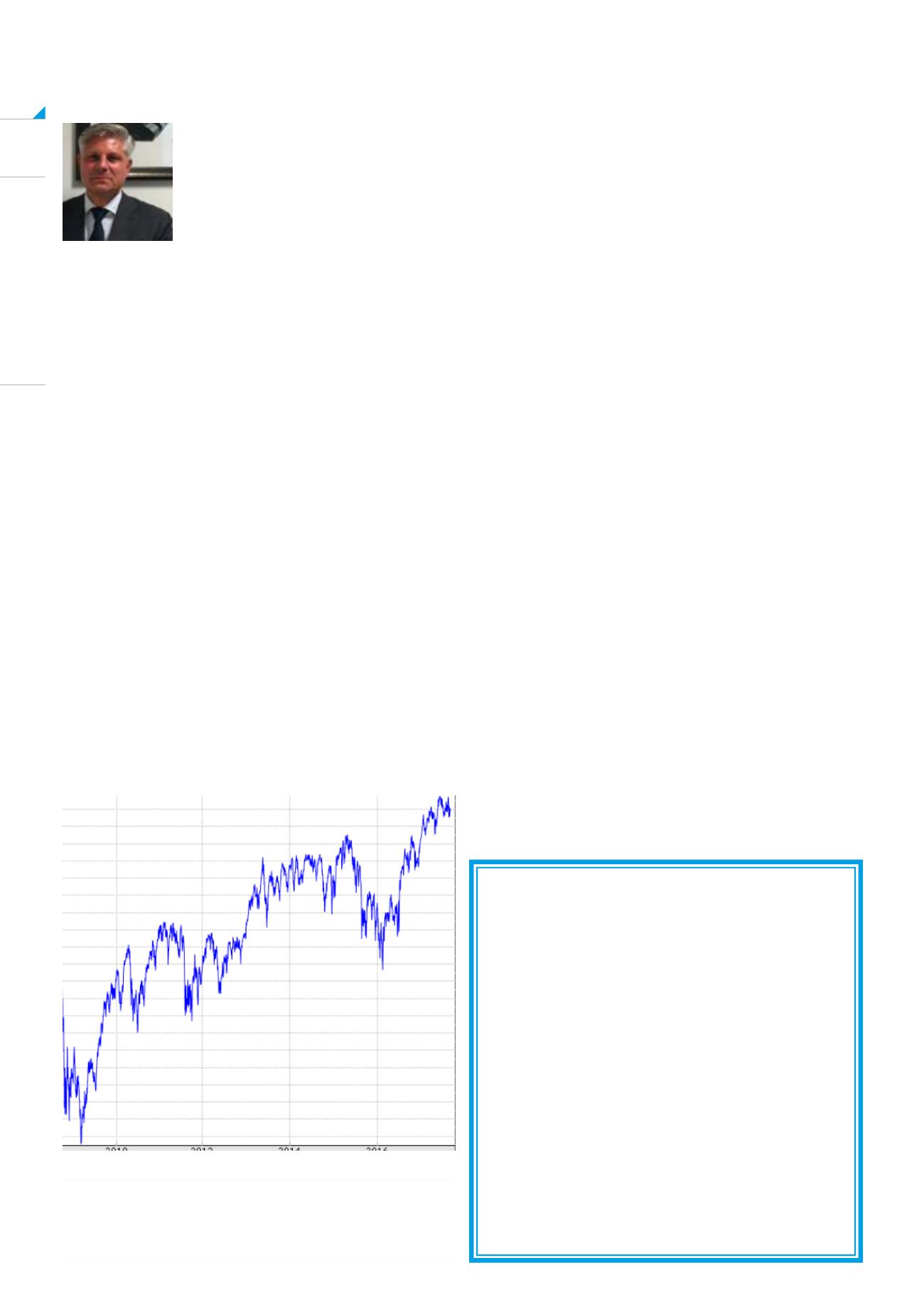

Where, or, if the crisis ever stopped, no one is sure, but

the FTSE bottomed below 3700 around the 2nd March

2009. Today (25th August) it is double that, 7423. The

following graph shows the bull market that followed.

The problem has been that for many it hasn’t felt like

that; we have seen deflation followed recently by

inflation ahead of Bank of England targets, 9 years of

record low interest rates, and the biggest asset bubble

in history being inflated. In short, the rich have got richer

whilst the rest of the population has got poorer.

Oh, and then there is Brexit, and maybe stagflation……..

So strange has the investment situation become that

one commentator remarked, for years we bought bonds

for income and stocks for capital growth, now it’s the

other way around.

The current dividend yield on the FTSE is 3.8%, ahead

of any investment grade bond; even Greek government

10-year bonds yield only 5.4%. In essence, many of the

indicators are pointing to something going wrong.

Jim Rogers the well-known investor and commentator

predicts the worst crash in our lifetime. The following is

from Business Insider June 9 2017;

Rogers:

It’s going to be the biggest in my lifetime, and I’m

older than you. No, it’s going to be serious stuff.

We’ve had financial problems in America — let’s use

America — every four to seven years, since the beginning of

the republic. Well, it’s been over eight since the last one.

This is the longest or second-longest in recorded history, so

it’s coming. And the next time it comes — you know, in 2008,

we had a problem because of debt. Henry, the debt now,

that debt is nothing compared to what’s happening now.

In 2008, the Chinese had a lot of money saved for a rainy

day. It started raining. They started spending the money.

Now even the Chinese have debt, and the debt is much

higher. The federal reserves, the central bank in America,

the balance sheet is up over five times since 2008. It’s going

to be the worst in your lifetime — my lifetime too. Be worried.

I LEAVE FOR 2 WEEKS HOLIDAY IN ITALY; BE AFRAID, BE

VERY AFRAID……