DIY Investor Magazine

| August 2017

20

AS INVESTORS FLOCK TO DIY PLATFORMS, CITY WATCHDOG

LAUNCHES PROBE INTO CHARGES AND TRANSPARENCY

FCA to ensure ‘wealthtech’ platforms deliver good value

to investors

Since the government’s Retail Distribution Review

forced advisers to charge upfront fees rather than to

take commissions from the products they advised on,

investors have rushed to DIY investing platforms in order

to take personal control of their finances:

Muckler

takes

a closer look to see what we can expect as the FCA

investigates whether they receive good values from the

platforms.

Those believing that their advice had been ‘free’ were

often horrified to see the true cost of advice, whilst

others were ditched as unprofitable by their advisers

because they had too little to invest; the result has been

a boon for online brokers and platforms as investors

have piled into them as well as the rise of automated

advice – ‘robo advice’ - platforms.

According to the FCA, DIY investing platforms held

some £592billion of investors’ money in 2016, compared

with £108billion in 2008, with a further £100billion held

with D2C platforms operated by banks, insurers and

wealth managers.

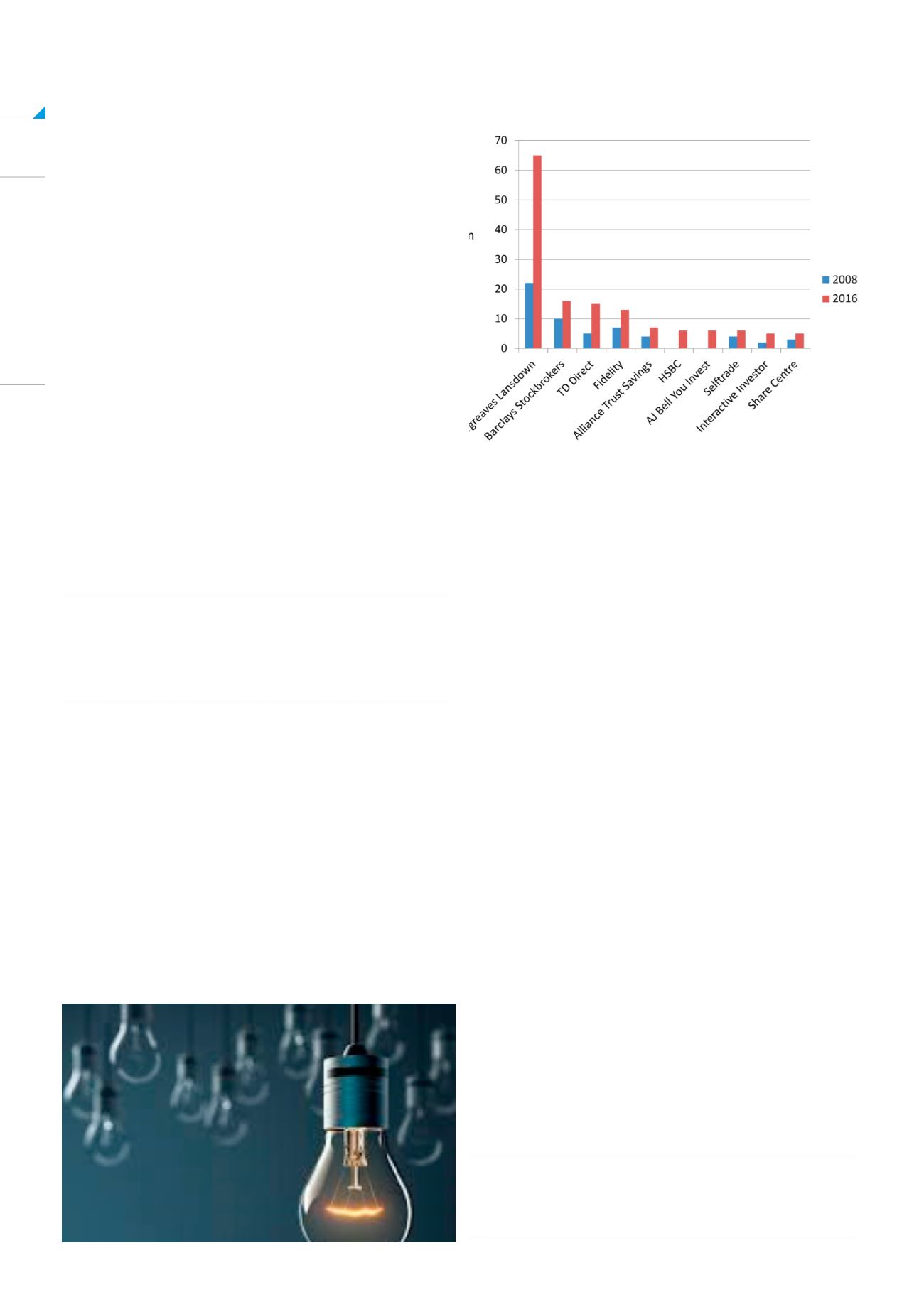

The chart below shows the dramatic growth that some

platforms have experienced and the FCA is anxious to

ensure that customers are getting value for money, that

the brokers’ bargaining power is being passed on and

that there is price transparency.

‘DO IT YOURSELF, DO IT WITH ME OR DO IT FOR ME – HAVE

BECOME INCREASINGLY PREVALENT SINCE RDR AND THEIR

IMPORTANCE CAN ONLY INCREASE’

MANY PROCLAIM ‘FIRE’ AS THEIR OBJECTIVE – FINANCIAL

INDEPENDENCE, RETIRE EARLY

FIG 1: FCA’S FIGURES SHOW THE SURGE IN DIY

INVESTING PLATFORMS

The watchdog is to probe whether DIY investing

platforms deliver value for money to the large and

increasing number of investors that use them to buy

funds, shares and other investment products; it will also

spotlight the increasing number of model portfolios

that are on offer to ‘Do it With me’ investors looking

for an off-the-shelf portfolio as well as the ‘own brand’

funds that companies such as AJ Bell You invest and

Hargreaves Lansdown have brought to market.

The probe was announced last month alongside the

FCA’s review of the fund management industry, which

called for firms to publish a ‘single, all-in-fee’; this would

mean that costs such as trading commissions, which

were previously ‘hidden’ in the fund, therefore affecting

its performance, would be made explicit, allowing

investors to see exactly what they are paying.

FCA executive director Christopher Woolard, said:

‘With the increasing use of platforms, and the issues

raised by our previous work, we want to assess whether

competition between platforms is working in the interest

of consumers. ‘Platforms have the potential to generate

significant benefits for consumers and we want to

ensure consumers are receiving these benefits in

practice.’ ‘The Financial Conduct Authority will explore

whether platforms help investors make good investment