DIY Investor Magazine

| August 2017

23

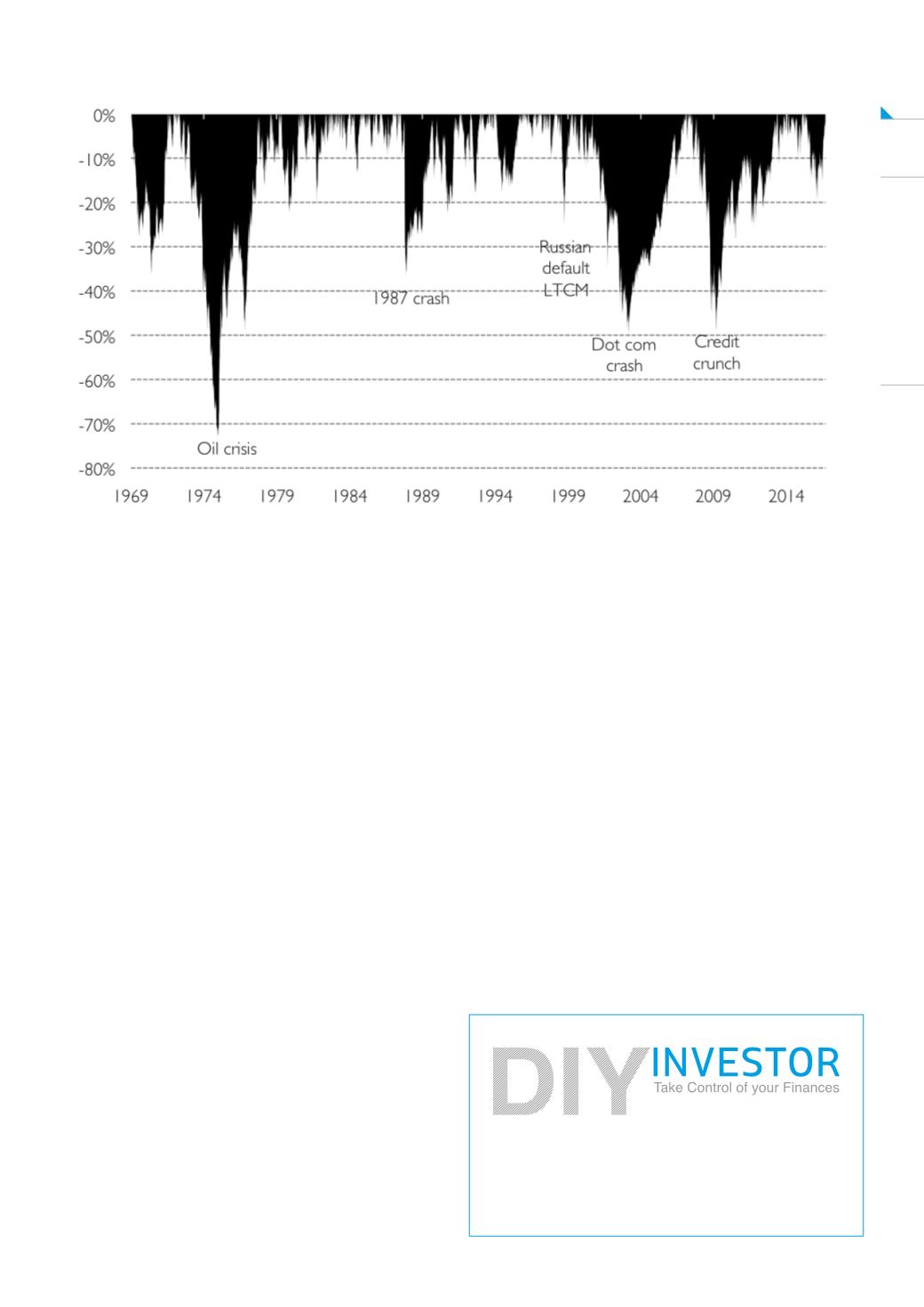

The first thing to notice about the chart is that there are

an awful lot of drawdowns! In fact, because the market

doesn’t make new highs every day, it is usually in a

drawdown state. And this can have a psychological

effect on investors.

If you look at a typical long-term chart of the stock

market, and many individual shares, you will usually

see a line that starts at the bottom left and increases

(moderately steadily) to the top right.

This is a good thing – stocks go up in the long term!

However, this chart does not necessarily reflect the

actual experience of being invested in the market over

this period. For this, the drawdown chart above may

more accurately represent the feelings of investors.

This is because investors’ portfolios are underwater for

most of the time, i.e. the portfolio value is below its peak

value (which will likely be a recent and strong memory

for the investor).

The table below down how long the market spends at

various drawdown levels. So, for 16% of the time from

1969, the market had a drawdown of 5%-10%, and it

was in a drawdown state of over 20% for 27% of the

time. And, while a drawdown of just up to 5% may not

seem very much, in practice it is 31% of the time that

investors are likely feeling slightly disgruntled, having

“lost” money.

Drawdown

Time spent

0% to 5%

31%

5% to 10%

16%

10% to 20%

21%

Greater than 20% 27%

So, while the data shows us that stock markets increase

over the long term, the direct personal experience of

investing may be for investors largely that of a prevailing

sense of loss. This sense of loss is something that

investors have to learn to live with.

To purchase this book for the special DIY Investor price

of £18 + P&P (RRP £25) use the following promotional

code when checking out at the Harriman House online

bookshop: DiYEE15.

The following chart shows the drawdowns for the FTSE All-Share for the period 1969-2016.