DIY Investor Magazine

| August 2017

22

SEPTEMBER MARKET SEASONALITY EFFECTS & ANOMALIES

The latest edition of Stephen Eckett’s fascinating

reference book may have you scratching your

head in search of a rational explanation for what

is presented, but one thing is for sure, you’ll

return to it again and again as 2017 unfolds.

The UK Stockmarket Almanac

Market performance this month

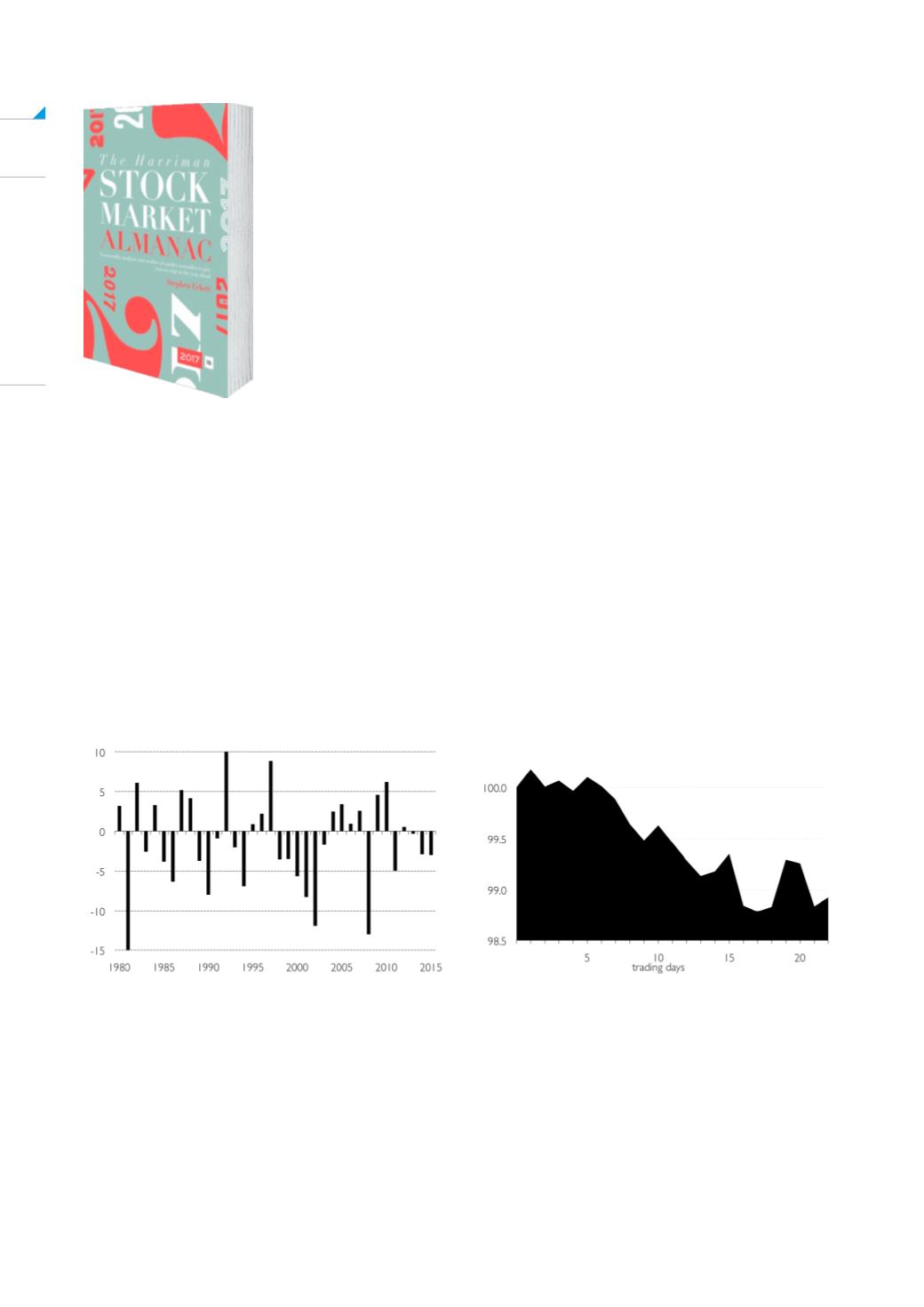

After summer the stock market tends to burst back into

life in September. Unfortunately, the renewed activity in

shares tends to be on the downside. Since 1984, the

FTSE 100 has an average return of -1.1% in this month,

which gives September the worst record for shares of

any month in the year. And things haven’t improved

recently – since year 2000 the average return in

September has been -1.9%.

The Psychology of Drawdowns

September has a reputation for market volatility, so let’s

look at losses.

How do investors measure unrealised losses? One way,

of course, is to compare the current price with the price

paid for an investment. So, for example, if you pay 100

for an investment and its current market price is 90, then

you are sitting on a (unrealised) loss of 10%.

However, although the average return is bad for the

month, about half of all Septembers actually have

positive returns. The problem is that when the market

does fall in this month, the falls can be very large. For

example, as can be seen in the accompanying chart,

the market has fallen over 8% in three years since 2000.

In an average month for September, the market tends

to gently drift lower for the first three weeks before

rebounding slightly in the final week – although the final

trading day (FTD) of the month has historically been one

of the weakest FTDs of all months in the year.

But if, after buying the investment at 100, the price had

risen to 120 before then falling back to 90, then there is

the temptation to anchor the price at 120 and regard the

current price of 90 as a 25% loss.

This 25% loss is referred to as the drawdown, which is

defined as the percentage loss from a previous peak.

The concept is common in trading but can also be

useful for investors.