DIY Investor Magazine

| August 2017

34

IS IT ALL DOOM AND GLOOM FOR UK DOMESTIC CYCLICALS?

The UK is leaving the EU, economic growth is slowing, household disposable income is being squeezed and interest

rates only have one way to go

David Smith

Henderson High Income Trust.

The case for UK domestic cyclicals – those businesses

whose earnings rise and fall in-line with the broader

economic cycle – could be considered as poor as a

Conservative election campaign. Indeed domestic

cyclicals have materially underperformed since Brexit,

but is it all doom and gloom or has it created a longer

term buying opportunity for some good quality albeit

cyclical businesses?

One of the key considerations in our investment process

is valuation; or in other words, what the current share

price implies about the quality of a business and its

future prospects. I agree that the outlook for the UK is

uncertain but I would also argue the risks are already

well known and hence valuations reflect this uncertainty.

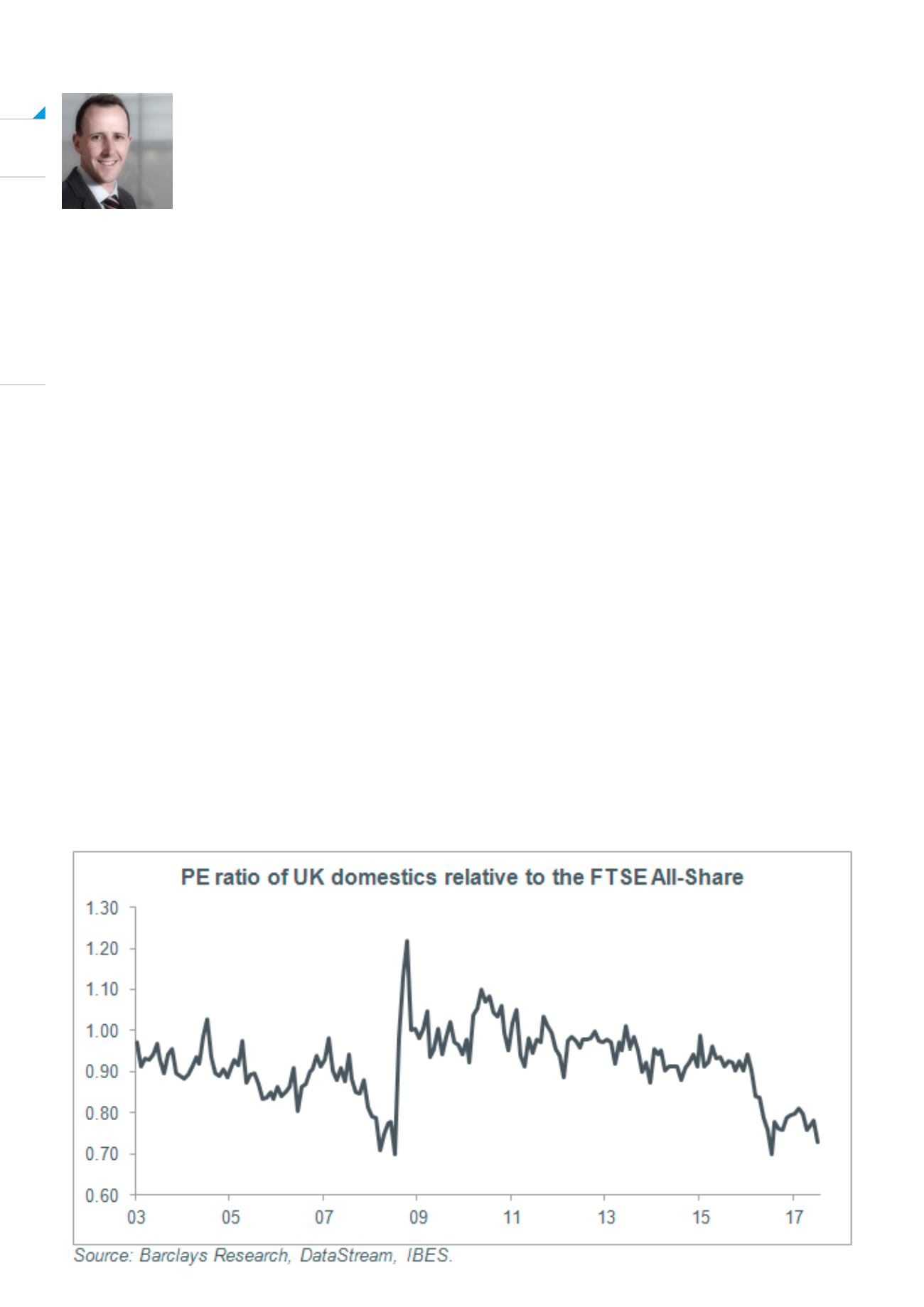

The chart below shows the valuation of UK domestic

cyclicals compared to the UK market.

As you can see domestic cyclicals are the cheapest

they have been relative to the market since the last

recession. Remember that was the worst recession

for a number of decades. Are things really that bad?

Unemployment is low, consumer leverage remains

below previous peaks while there seems to be signs

of wage growth. In recent weeks we have seen results

and trading updates from domestic companies such as

Next and Pets at Home. Both delivered what can only

be described as remarkably in-line statements with no

change to analysts’ earnings forecasts.

Despite this, both share prices were up strongly on

the day of their results showing how far sentiment and

valuations had fallen for these companies.

Although the fears over the UK economy may play out,

I feel the share price under performance in certain

domestic companies has presented an attractive

buying opportunity for some good quality albeit cyclical

businesses.

Two examples are Whitbread and Lloyds. Whitbread,

owner of Premier Inns and Costa Coffee, has leading

market positions, strong brands, a robust balance sheet

and is underpinned by freehold property.

The company still has good opportunities to expand the

business through the roll-out of its key brands which

should drive higher profits over the longer term.

Although short term trading concerns have put pressure

on the share price this has created a compelling