DIY Investor Magazine

| August 2017

37

BENEFITS OF HAVING HIGH-GRADE GOVERNMENT BOND ETFS IN YOUR PORTFOLIO

•

Diversification benefits

•

Stability during recession periods

•

Price increase when interest rates fall, inflation lowers and/or home currency

weakens against bond currency

WHAT ARE THE RISKS OF GOVERNMENT

BONDS?

In the current low interest rate environment, many

assume that rates must rise which will cause bond

prices to fall; this will inflict capital losses on bond

investors although they are only temporary for bond

ETFs, because ETFs automatically buy new higher-

yielding bonds that eventually make good the loss

by reinvesting more income into cheaper bonds.

However, interest rates are not guaranteed to rise

just because they’ve hit historical lows, Japan’s

rates have not recovered in over a quarter of a

century. If you don’t believe that can happen here

then you can minimise the risk of rising rates by

investing in a

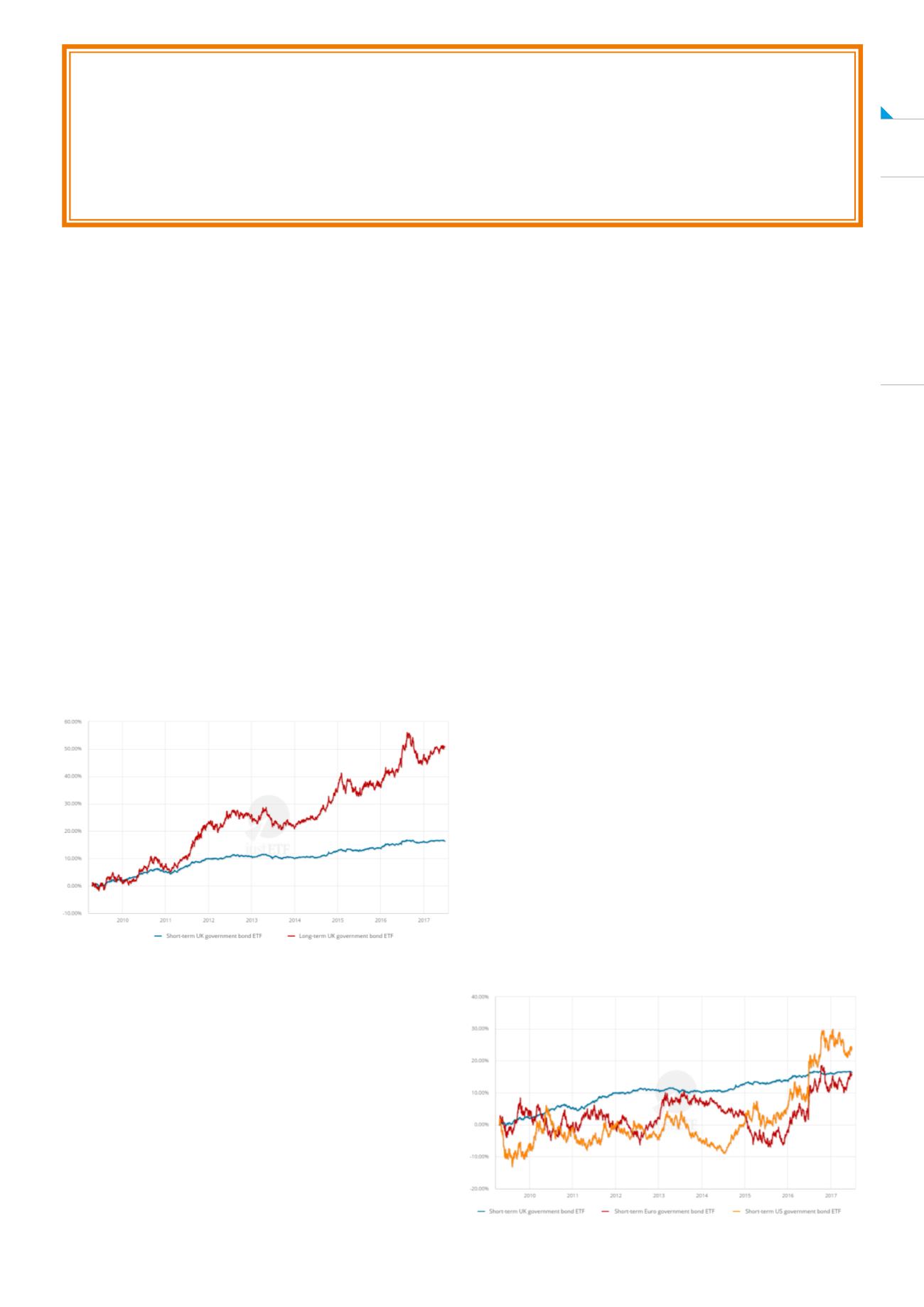

SHORT-TERM VS. LONG-TERM GOVERNMENT

BOND ETFS

Source: justETF.com; 17/04/2009 - 26/06/2017

A rise in interest rates would at least solve the rock

bottom coupon payments currently offered by

government bonds yield more as rates rise, and

this would enable them to return to their traditional

role as a decent source of income.

Inflation risk

is another issue for government

bonds - the chance that your bond returns don’t

keep pace with inflation. Low yielding bonds are

particularly vulnerable to rapid and unexpected

increases in inflation. Solutions include diversifying

into:

•

Inflation-linked bonds that match

inflation hikes.

•

Commodities that have historically

done well in high-inflation environments.

•

Short-term bond ETFs that rapidly

replace low coupon bonds with higher

yielding versions as interest rates rise.

•

Relying on equities and property holdings

to outpace inflation as they have done

over time.

Credit risk

is another trap for the unwary. This is

the risk that a government defaults on its debt and

fails to pay you back as promised.

You can minimise this by investing in government

bonds of high quality: look on your bond ETF’s fact

sheet for average credit ratings of AA- and above.

The final thing to think about is

.

Government bonds are meant to be a source of

stability but foreign bonds add currency market

volatility into the mix.

This can swing both ways. If the pound drops

5% against the dollar then a US Government

bond fund will appreciate by 5% regardless of

the performance of its underlying asset. Equally,

a strengthening pound will detract from the

performance of overseas assets.

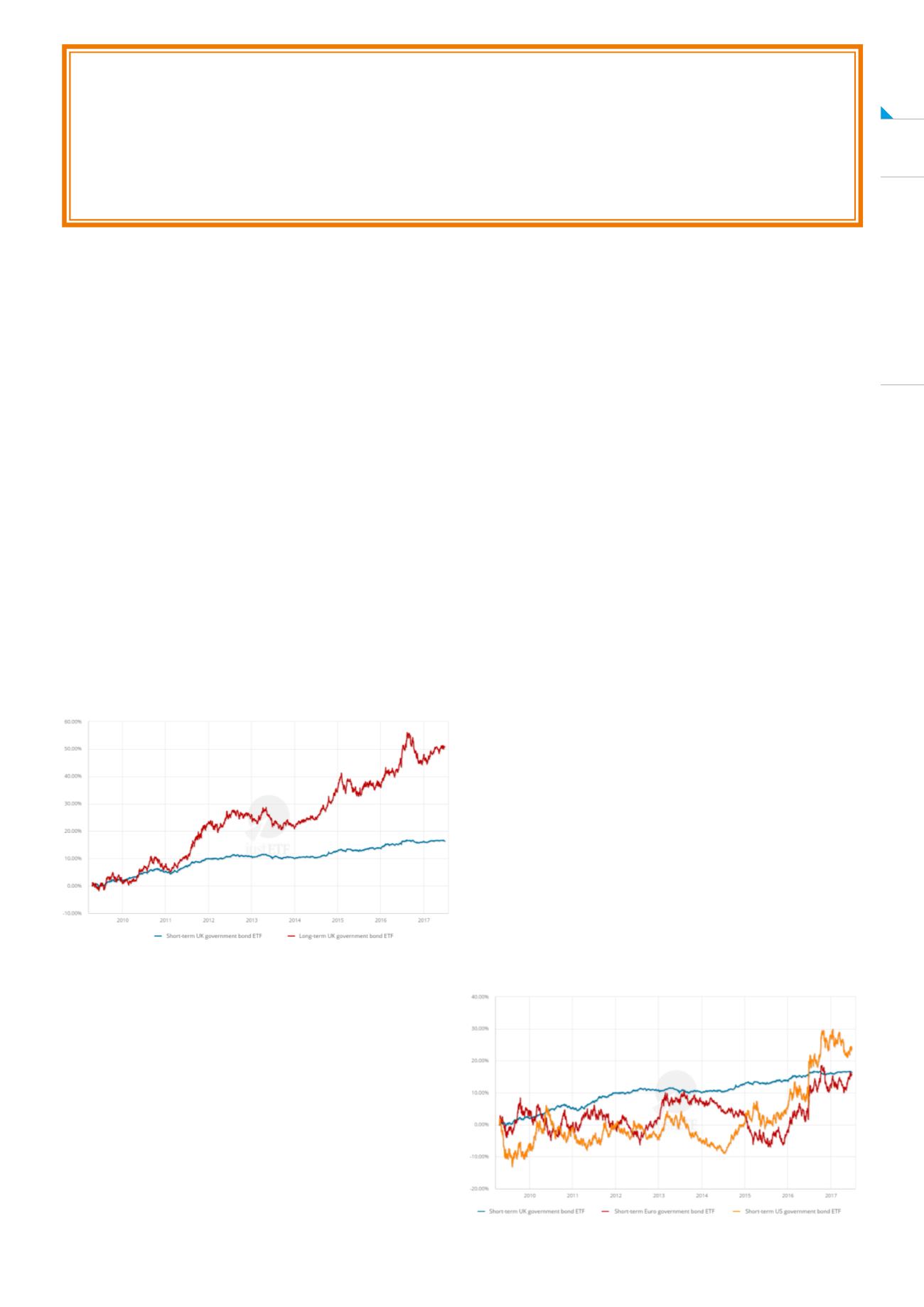

Short-term UK vs. short-term foreign currency government bond ETFs

Source: justETF.com; 17/04/2009 - 26/06/2017