DIY Investor Magazine

| August 2017

41

As more growth companies are paying out

dividends to shareholders, so investors can enjoy

an increasingly diversified portfolio that offers

income and the potential for growth.

Studies indicate that dividends generate a

significant proportion of the total returns from

equities over time.

Being committed to financing a dividend on a

continued basis means that companies have to

be well-financed and capable of producing a

sustained cash flow.

Past performance is not a guide to future

performance. The value of an investment and the

income from it can fall as well as rise and you may

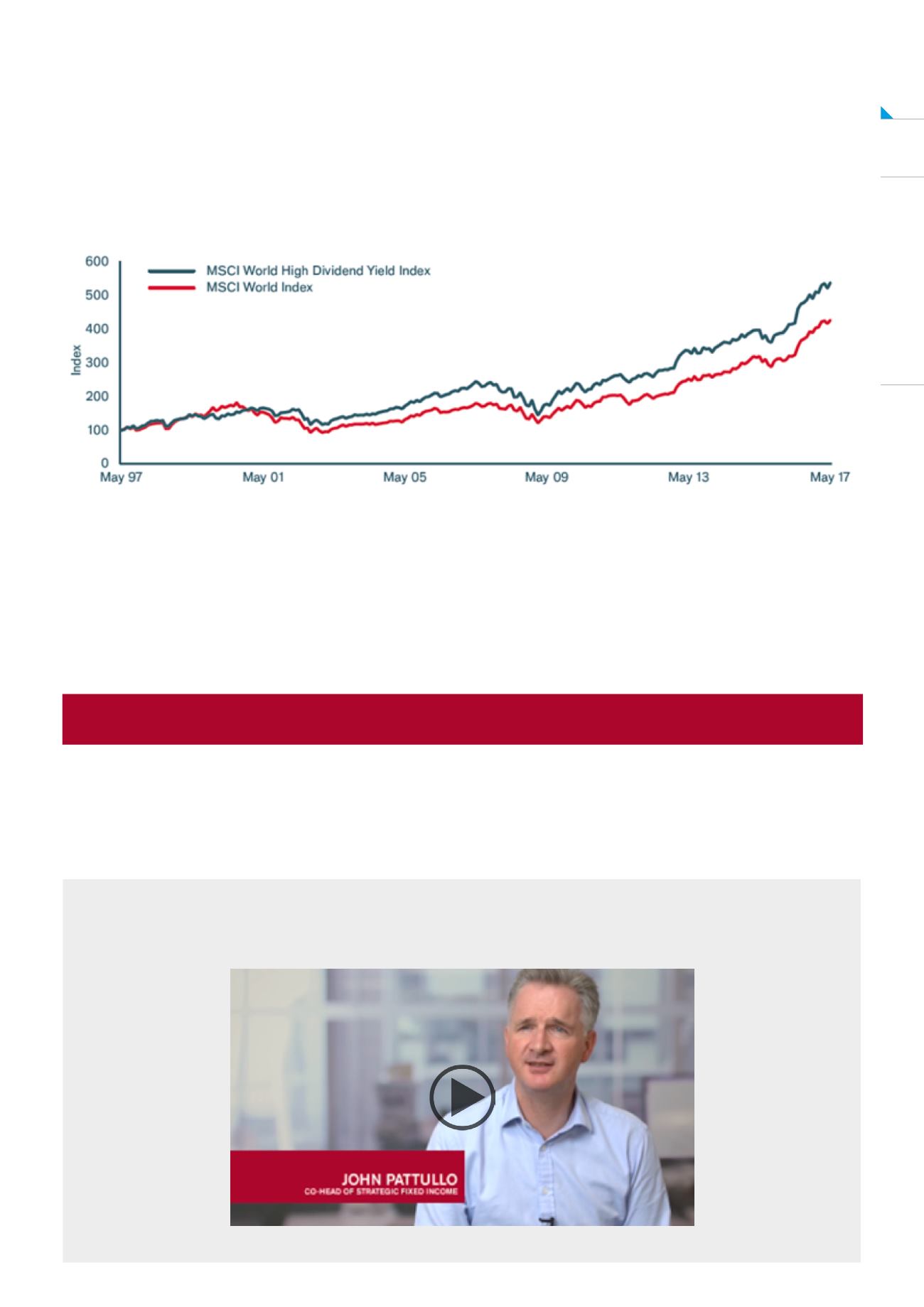

The combination of reinvested income along

with capital growth has led to the long-term out

performance of higher dividend-paying companies

when compared to the wider equity market, as

shown in the chart below.

HIGHER DIVIDEND-PAYING COMPANIES HAVE

HISTORICALLY OUTPERFORMED THE MARKET

Source: Thomson Reuters Datastream, 31 May 1997 to 31 May 2017, total return indices, in sterling terms, rebased to 100. Past performance is not a guide to future performance. Yields

may vary and are not guaranteed.

There is also evidence that this makes the

management team more disciplined when it

comes to decision making. *United Nations, World

Population Ageing report, 2015

not get back the amount originally invested.

The information in this article does not qualify as an

investment recommendation.

QUESTIONING THE MANAGER – JOHN PATTULLO

HENDERSON DIVERSIFIED INCOME TRUST