DIY Investor Magazine

|

Oct 2017

17

How are they disruptive? Well, they are managed to be

full, not to be fancy and exclusive.

Rooms are clean, comfortable and with an emphasis

on the home comforts – excellent showers, comfortable

bedding and so on – being provided without

compromise.

At the same time, though, there is a great attention to

detail on cost, whether that’s on light bulbs or flooring or

door fittings.

It makes a huge difference. Dalata has imported

booking and load management systems from the airline

industry and, unlike many of its peers, is not a slave

to online room vendors. As a result, its hotels boast

occupancy rates well above industry levels.

Banking on technology disruptors are also at play in the

banking sector.

Norway’s Skandiabanken is a fine example: the

company broke away from Swedish Skandiabanken in

2015 and is now Scandinavia’s largest internet-based

bank.

Online only and free from the legacy assets and

challenges that so often afflict Europe’s banks,

Skandiabanken is an interesting case in that it does not

disrupt on price – in fact, it is middle of the road.

However, its focus on a quality banking offering, the

usability of its app and the level of its online experience,

coupled with market-leading innovation when it comes

to financial product-creation, means that it is taking

market share from big incumbents, most notably the

cumbersome and in-efficient savings banks.

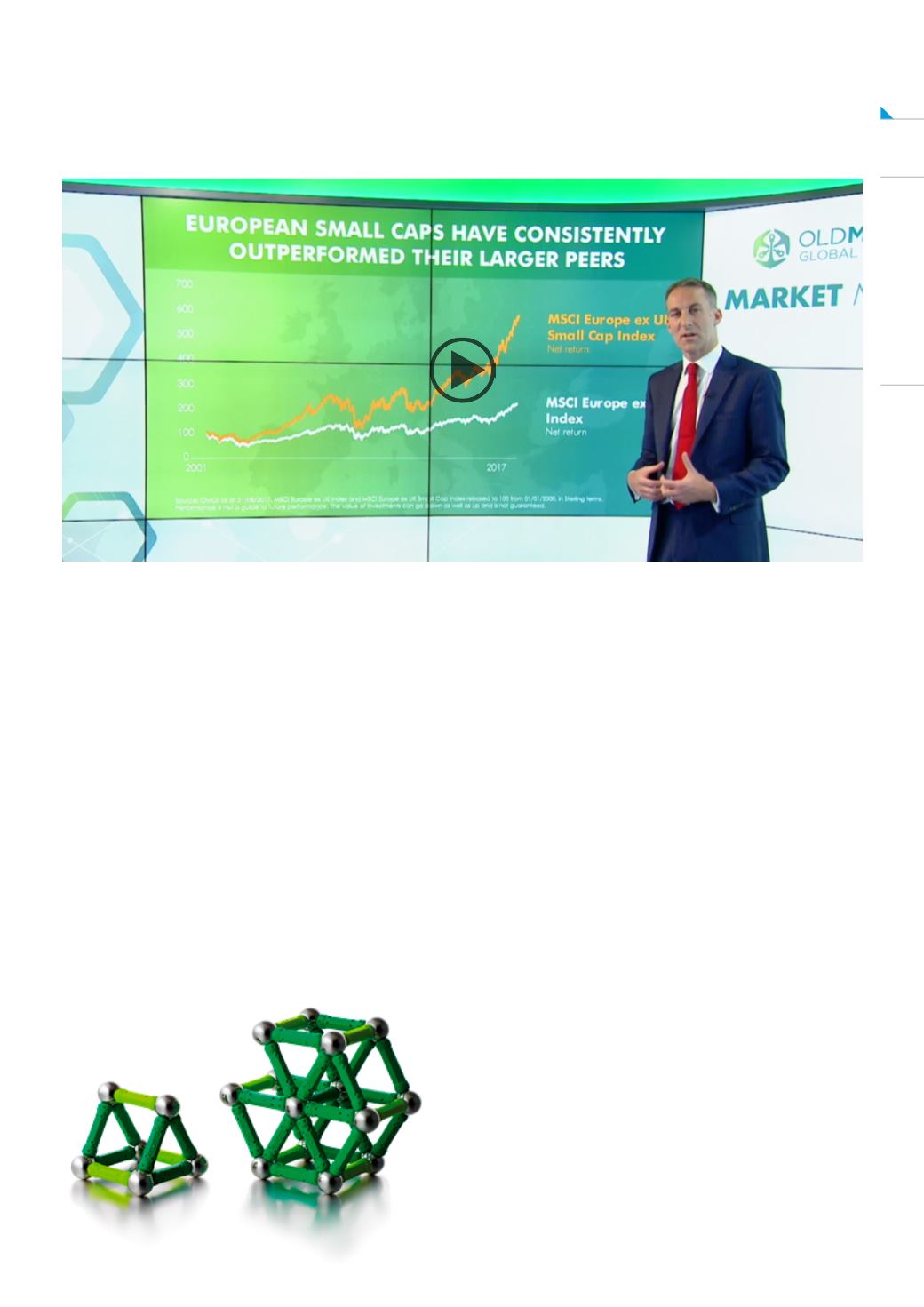

MISSED THE EUROPEAN SMALL CAP RALLY?

Ian Ormiston, manager of the Old Mutual Europe (ex-UK) Smaller Companies Fund explains why European small-

cap investors could still reap their rewards.